March-April 2025

FEATURED ARTICLE

Build on Our MomentumDuring TXCPA's 2025 Advocacy Day at the state Capitol, CPA professionals met with legislators to discuss proposed legislation on alternative CPA pathways and mobility. These efforts strengthened relationships with lawmakers, positioning CPAs as trusted advocates for the profession. The positive feedback from legislators reflects the impact of these advocacy efforts.

- Business and Industry

- Professional Issues

- Professional Standards

- Public Practice

- SASB

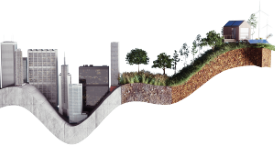

The Sustainability Accounting Standards Board (SASB) provides industry-specific guidelines for companies to report on ESG factors that impact financial performance. Companies use SASB metrics to enhance investor transparency and manage ESG risks. While SEC regulations on sustainability remain pending, over 3,000 companies worldwide have voluntarily adopted the standards to improve corporate performance.

By Sunita Rao, Ph.D., and Barbara Scofield, Ph.D., CPA

- Becoming a CPA

- Leadership

- Member Benefit

- Membership

- Volunteer

TXCPA chapters across Texas hosted various events to engage members and support future CPAs. TXCPA Dallas held a Coffee & Connections event, while TXCPA East Texas members inspired students at UT Tyler’s Beta Alpha Psi meeting. TXCPA Fort Worth welcomed new licensees at a luncheon and in San Antonio, members celebrated new iDEAL graduates and elected the 2025-2026 Officers and Directors.

- Business and Industry

- Membership

- Volunteer

Shilpa Boggram Sathyamurthy is an accounting profession leader with experience in both public and industry accounting. In this Spotlight on CPAs article, she discusses the differences in their focus, workload and learning opportunities. She also actively contributes to TXCPA through committee service, valuing collaboration and professional development.

Classifieds

Classifieds

The classified ad section features listings for practice owners looking to sell, professionals seeking firms to purchase and a variety of specialized services. Whether you're looking to expand, sell or explore niche opportunities, these classified ads can connect you to valuable business prospects and resources.

- Becoming a CPA

- Member Benefit

- Membership

The TXCPA Accounting Education Foundation (AEF) awards scholarships to outstanding students, providing not only financial aid but also connections to a supportive community of experienced professionals. Congratulations to these exceptional students for their dedication and commitment to excellence!

Take Note

Take Note

In this edition of Take Note: How to Get the Latest Updates on BOI Reporting; Safeguard What Matters Most; Accountants Confidential Assistance Network; Advocacy Day and Midyear Leadership Council Meeting; TXCPA Career Center; CGMA® Designation

- Business and Industry

- Professional Issues

- Public Practice

The SEC introduced new disclosure requirements for share repurchases, aiming to increase transparency. Under the updated rules, companies must now disclose daily repurchase data in quarterly reports. Companies must also disclose whether insiders traded in the four days before or after announcing a buyback. The rules do not specifically address accelerated share repurchase programs.

By Don Carpenter, MSAcc/CPA

- Federal Legislation

- Federal Taxation

- GASB

- Professional Issues

Texas contractors receiving government funding must maintain rigorous accounting practices, particularly in timekeeping and labor distribution, to ensure they are adhering to federal regulations. CPAs and finance professionals play a crucial role in enforcing applicable standards. Mastering timekeeping is essential to help meet federal standards and uphold the integrity of taxpayer-funded projects.

By Jim Wesloh

- AI

- Artificial Intelligence

- Professional Issues

- Tax

- Technology

In part 2 of a series, this article examines the risks and limitations of using AI in tax preparation. While AI tools like ChatGPT, Copilot, Perplexity, and TaxGPT can assist with tax research, their accuracy depends on precise prompts and professional oversight. Responses are often outdated, misleading or incorrect, posing risks to professionals who rely on them without verification.

By William M. VanDenburgh, Ph.D.; Kimberly J. Tribou, Ph.D., CPA; and James M. Braswell, Ph.D.

- Becoming a CPA

- Leadership

- Legislative Advocacy

- Volunteer

With the profession facing a talent shortage, legislative efforts are underway to introduce alternative pathways to licensure. Additionally, bills have been introduced to address CPA mobility and practicing accounting across state lines. TXCPA members took action at the Texas Capitol to address and emphasize the importance of these initiatives in strengthening the profession.

By Kenneth Besserman and DeLynn Deakins

- Ethics

- Professional Standards

Codes of conduct serve as essential guidance for organizations, ensuring ethical behavior, regulatory compliance and corporate integrity. This article examines the significance of codes of conduct, highlighting examples from Fortune 500 companies. Effective implementation involves executive endorsement, ongoing communication and integration, and reinforcing accountability.

By Steve A. Garner, Ph.D., CPA, CFE

- Business and Industry

- Professional Issues

- Professional Standards

- Technology

ASC 842 compliance remains challenging as organizations manage complex lease portfolios and multiple accounting systems. While standard software offers reporting features, many require custom solutions to integrate specific accounting attributes and enhance internal controls. Using a structured approach to developing custom reports can help improve efficiency and support the decision-making process.

By Shilpa Boggram Sathyamurthy, CPA, CA