The Perfect Storm

Part 1

By Bill Reeb, CPA, CITP, CGMA

February 2019

What a title ... “The Perfect Storm is Coming for Our Profession!” This may sound overly dramatic. It may also sound very ominous, but it may come across as somewhat hokey, as well.

However, I do believe the perfect storm is sitting in the Atlantic Ocean, far away, but definitely heading right toward us. We have plenty of time to prepare, as long as we start preparing right now. And depending on how we prepare, in my opinion, we can avoid most of the devastation that could be caused by being in its wake.

In fact, quite frankly, we may be able to turn some of the storm’s energy into our advantage, or we can simply play ostrich and pretend that the storm is fake news. In that case, we are likely to watch the most valuable assets we have, our livelihoods and the profession we have worked so hard to nurture and build, be irreparably damaged by the storm’s surge.

What am I talking about? For something to be considered a perfect storm rather than just any common storm, multiple high-impact conditions need to be on a collision course targeting the same destination to create a devastatingly damaging environment. Some of those conditions (briefly mentioned below with more to follow on each one) are:

- With the demographics of our profession, there are a lot of baby boomers who may soon be winding down their careers.

- The impact of demographics on the sale or merger of CPA firms will likely be the catalyst for a declining market value of CPA firms, due to a more competitive acquisition landscape that will disproportionately impact our smaller CPA firm owners and in many cases, the value of their largest single asset as they move into retirement.

- The integration of technology and robotics in processing transactional accounting work will lead to the decline in revenues produced from delivering our firm’s traditional services in the future.

- Our global economy continues to open up our marketplace in the United States to new competitors offering traditional services at much lower prices.

- The accelerating need of our professionals to have very strong technology skills in data analytics, automated accounting systems and processes to continue to be able to perform our jobs in the future. We will need to be able to shift from simply working around the automated systems to working through them, as well as to be capable of challenging how those systems are making decisions.

- To continue to sustain the accelerated success our profession has been enjoying for the past few decades, we can’t do what we have always done. We have to be able to shift our services to deliver higher value to our clients.

- To deliver higher-valued services, our skill sets and competencies need to evolve at a very rapid pace. Not only are most organizations NOT addressing this at a fast-enough pace, even those that are making the investment in competency development are often doing so more on the technical side than on the “soft-skill” side. The problem with this is that when you look at where our profession is heading with service delivery, I believe the quality of those “soft skills” will prove to be a greater predictor of our future success than the technical ones.

- The mergers, amalgamations or joint ventures that cross national borders for the United States/United Kingdom, Australia/United Kingdom and Australia/New Zealand are in a state of flux.

- There are licensure issues within the United States with 1) young people less interested in following a rigorous path to licensure and 2) many grassroots campaigns underway in various state legislatures to eliminate licensure, even at the CPA level, altogether.

Any one or two of these nine factors by themselves, in storm parlance, would be enough to create a very damaging weather phenomenon. But when you consider all seven of those conditions converging on our profession in the same five-year period, my perfect storm analogy is NO hoax; it is NOT overly dramatic, and it will likely be VERY ominous to our profession and our professionals if we don’t start taking seriously how we need to change now and be willing to change in a big way.

The Demographics of Our Profession

When you look at AICPA membership, although it does not include all CPAs, it is a reasonable representation to make a point. Baby boomers, as compared to the combination of those classified as Generation X and Millennials, represent about 43 percent of AICPA membership, according to an AICPA presentation sharing 2017 data on regular voting members, which excluded honorary members (baby boomers and those older than baby boomers), college students, CPA exam candidates and associate categories. For clarity, the baby boomer group is comprised of those born between 1946 to 1964, with the first entrants of that group turning 73 this year and the last turning 55.

Simply put, our profession, like most every profession in the United States, has a lot of baby boomers who can now see their personal horizon for winding down their careers. Many of them are not in the mode of, nor do they have a strong appetite for, reinventing themselves and their skills sets to compete in the decades to come. The coming decades requiring this reinvention are referred to by many as the beginning of our 4th industrial revolution (the expansion of cost-effective capability, due to advanced technology and robotics solutions).

When you consider the appetite for change within the rank and file of our profession, a profession that has never done better economically than we are currently experiencing today, the change that is being embraced by the vast majority of firms is, at best, one of continuous improvement (or small incremental changes). This certainly shouldn’t be a shock, as there is a common saying that supports this position, which is “if it ain’t broke, don’t break it!” How can a profession doing better than it has ever done before be broken?

The fact is ... we are NOT broken now!! But there is a storm on the horizon coming our way and after it hits, we are not prepared for the aftermath. Storms hit fast and when they are devastating like this one is poised to be, people can’t believe how their lives change in an instant. Get out of your comfort zone, look at the signs on the wall, read the tea leaves, or do whatever it takes to understand how and why our profession will be changing soon.

If you have a few people in your firm with a short horizon to retirement who want to ride out the storm by doing what they have always done, then great. That might be the perfect path for them to retire. But don’t let those people put your firm in a position where you are NOT ready for the storm that is brewing. It’s time to stop talking about change and start doing it. It’s time to start re-engineering our firms to make the changes that the 4th industrial revolution is calling for.

The Impact of Demographics on the Sale or Merger of CPA Firms

Due to the number of CPAs in our profession entering their retirement window during the next five years or so, and given the number of single owner firms that will be in the market to sell (or merge to sell), the landscape for merger and acquisition (M&A) of small firms will seemingly overnight become a buyer’s market. Acquiring firms have a limit as to how many organizations they can successfully assimilate into their cultures at a time. For most, that would aggressively be about one per year. Therefore, as the number of sellers grows, with the buyers being limited as to how fast they can take on the next opportunity, we believe the basic tenants of economics will prevail. Prices will begin falling as the availability of sellers will outpace what the buyer can successfully assimilate.

We expect this to create an M&A mania within our profession that will make the past M&A frenzies seem calm. This will not only be fueled due to the baby boomer generation reaching ages that are historically older than past retirement ages, but also because CPAs are choosing to retire later in life, which then exacerbates the situation by adding in a number of unexpected short-notice transitions caused by personal medical events. The fact that retirement plans for many small firm owners assume they will receive a strong market value when selling their firm only makes this storm even more personally devastating.

We already see M&A stressors in the market now. For example, according to the PCPS and Succession Institute Succession Planning Survey, conducted every four years, with the last survey occurring in 2016, following are some disconnects to consider.

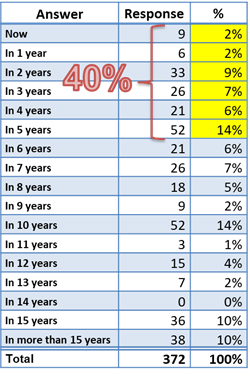

As you can see by the graphic from the 2016 survey, 40 percent of the group, comprised of sole proprietors and solo practitioners, plan on retiring in the next five years. Now, our experience says that a lot of people say they are going to retire within the next five years because it is that perfect place of non-accountability. In other words, my retirement is far enough away that I don’t need to do anything different right now, but short enough to say “I can just do what I have always done and not worry about the changes in the marketplace because I will be phasing out soon.”

To me, this means that a large percentage of small public accounting firms are going to want to position themselves to keep things the same just long enough for them to transition into retirement, which will be soon. That perspective can create a crisis within our profession, because we can have large factions fighting for change to make sure our profession is as strong or stronger in the next decade than it is today, with another large faction just wanting to keep things from changing too much so their skills and capabilities will be relevant until the day they decide to hang up their shingle.

Let’s say that this 40 percent number, which is huge when you consider how many firms might be gone in five years, is an exaggeration. While it might be, and even if it is and is only half-way correct, that is still a great deal of transition coming soon. But we believe this 40 percent number is truer than it has ever been, because of the answers to this next question:

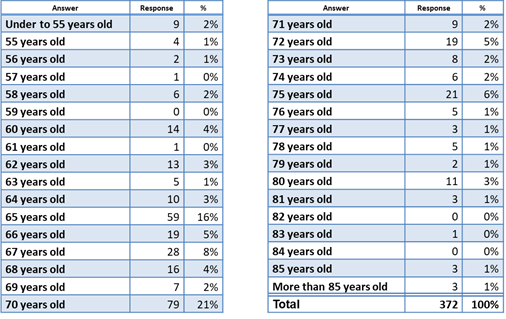

“At what age are you expecting to fully retire?”

Forty-eight percent of this group plans to retire at age 70 or older, while 16 percent plans to retire at 75 or older. Given that full Social Security age for baby boomers is likely prior to or near age 67, as you can see from these numbers, people are deciding to work longer. The longer people decide to work, the more likely medical and other family issues will end up being drivers of the final retirement decision date.

Consider that, according to 2017 data, about 140,000 members of AICPA are baby boomers and that the age of a baby boomer in the middle of that span of years is turning 64 this year (1946 - 1964), and there is a large number of solo owners of CPA firms who are saying they are going to retire by age 70 (56 percent say they will retire between 65 and 70 years of age). This confirms, in my view, that the planned five years until retirement stated in the first graphic is very real. It syncs up with the planned age of retirement and with the demographics of AICPA membership.

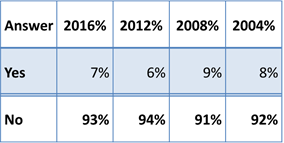

If you are starting to see that there is some evidence that many firms will transition in the next five years, let’s go over a significant disconnect working against our small firm owners. First, our small firms are flying blindly. They don’t have a plan to transition their firm to another generation (they are single owner firms), nor do they have another firm signed up to buy them out. Consider this graphic covering 12 years of data gathering. When asked, “Do you have an existing written Practice Continuation Agreement?” the answers were:

As you can see, our small firm owners have not made it a priority to put together a Practice Continuation Agreement because for as long as they have been around the marketplace, selling a CPA firm practice has not only been pretty easy, but pretty consistent. You could sell your practice, depending on the makeup of your clients, for anywhere from 75 cents on the dollar to up to 150 cents on the dollar. To be sure, the most common answer in the survey was a dollar paid by the buyer for a dollar of revenue received by the seller. The problem is while that is still pretty true today, the stressors, as I mentioned earlier, are changing what is behind that statement, which will have a definite impact on the overall price of the acquisition. To put it bluntly, while “a dollar for a dollar” is still a commonly referenced term, there is a giant gap between what the seller and buyer thinks that means, which once again, only raises the intensity of the possible brewing storm.

As you can see, our small firm owners have not made it a priority to put together a Practice Continuation Agreement because for as long as they have been around the marketplace, selling a CPA firm practice has not only been pretty easy, but pretty consistent. You could sell your practice, depending on the makeup of your clients, for anywhere from 75 cents on the dollar to up to 150 cents on the dollar. To be sure, the most common answer in the survey was a dollar paid by the buyer for a dollar of revenue received by the seller. The problem is while that is still pretty true today, the stressors, as I mentioned earlier, are changing what is behind that statement, which will have a definite impact on the overall price of the acquisition. To put it bluntly, while “a dollar for a dollar” is still a commonly referenced term, there is a giant gap between what the seller and buyer thinks that means, which once again, only raises the intensity of the possible brewing storm.

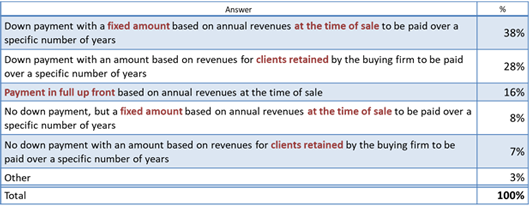

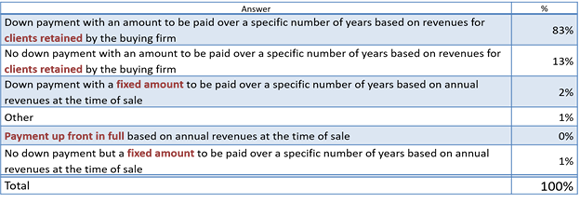

When we asked the solo owners what they thought they would get for their practice, here is what they said (and let’s assume that everyone was talking about the purchase price of “a dollar paid for a dollar of revenue,” which is not really true, but any price disconnect for revenue is not actually the scary factor). The question was, “Which best describes your expectation regarding financing the sale of your firm?”

When you focus on the words in red and then add up their corresponding percentages, you will quickly see that 62 percent of the solo owners in this survey expect to sell their CPA practice based on the fixed amount of their annual revenues at the date of sale.

Now, let’s consider the next question that we asked. This one was posed only to those people who had actually bought practices. We asked, “Which best describes YOUR APPROACH regarding financing the sale of a firm?”

Again, notice the words in red. Fully 96 percent of the buyers plan on buying the seller’s practice based on revenue retention. This can be translated as paying for those clients the buyer decides to keep, not whoever the seller worked with during their last year prior to the sale.

Why is this so critical? We have a large number of solo owners in our profession close to retiring and selling their practice at a time when many other baby boomers have the same idea and when pricing will not only get softer, but we clearly already have a huge disconnect in the market as to what that sale will look like.

This means that many within our profession have a storm on the horizon that could be very financially damaging to them as they enter the next phase of their lives.

We will pick up here in my next article starting with the third of nine high-impact conditions that are on a collision course from the storm targeting our profession and our professionals, which could be devastating.

Before you move away from this article, let me remind you that I started it by saying that I believe there is a perfect storm coming and that it could be devastating, but NOT that it would be. There are steps that you in your firms, and we as a profession, can take that can greatly mitigate the potential of devastating damage.

But I want to leave you with this thought. If you think that a small incremental change is all that is needed, either personally or professionally, then you’re not going to like where this article series is going. We need to start doing things differently ... embracing the kind of change that allows our profession to move up a level, not just stay on the same path moving a little faster. And this means we need to start doing different things if we want to change the conditions enough to allow the perfect storm to bypass us.

At a minimum, we must make the kinds of changes that, even if this perfect storm does hit us, we will have significantly reduced its ability to harm us. We will have positioned ourselves to leverage the likely aftermath. I look forward to sharing more next time and by the end of this series, tying it all together with some action steps as to what we should be doing to avoid the damage from a brewing perfect storm.