A CPA’s Guide to Data Analytics

By Izhar Haq, Sarah Hinchliffe and Christopher Bates

Data analytics has become increasingly common in businesses of all sizes and across all industries. It is enabling businesses to improve their operations, reduce costs and identify new business opportunities by better understanding their customers and improving the products and services provided to those customers.

Some aspects of data analytics can be a challenge to understand without some knowledge of statistics. However, the basic principles and the impact it will have on businesses and public accounting are important for CPAs to understand.

The same analytical tools used by companies to manage their operations will also provide CPAs the tools to better understand their clients’ operations and dramatically change the way that external audits are performed. These changes will be driven by the challenges to improve the services provided to clients while also reducing costs. The changes will also affect the skill sets needed by current as well as aspiring CPAs to effectively identify material omissions and misstatements in client financial statements.

The purpose of this article is to help practicing CPAs understand the basic concepts of data analytics, as well as its implications on businesses.

What is Data Analytics?

The phrase data analytics is derived from two words “data” and “analytics” and the simple answer would be that it is the analysis of data. Although most CPAs would equate data with numbers and spreadsheets, data in the context of data analytics could be numbers, but it could also be locational (gps), textual (product reviews), videos (yahoo), pictures, and so much more. Businesses have been analyzing data even before computers existed and most statistical and data analysis techniques have been around at least since the turn of the previous century.

What makes the current term “data analytics” different from data analysis in the past is that within the last two decades, the proliferation of the internet and significant increases in storage capacity has exponentially increased the amount of data that exists.

Companies have always had data on their customers and their operations, but it was not either readily available (documents and processes were primarily paper driven) or there was insufficient data storage and processing power available (data storage was much more expensive in the past).

The advances in computing speed and multi-processing have enabled the raw processing power to sift through the vast amounts of data collected. Business intelligence, which was a popular term commonly used in the business community over a decade ago, used data that companies had readily available at the time (financial, marketshare, capacity, etc.) to create an informational dashboard for executives to understand past activity of a business.

While business intelligence was backward looking, data analytics can look backwards and also be forward looking. It does not just summarize data, but strives to understand the underlying trends in the data

According to Lotame: “The term data analytics refers to the process of examining datasets to draw conclusions about the information they contain. Data analytic techniques enable you to take raw data and uncover patterns to extract valuable insights from it.”1

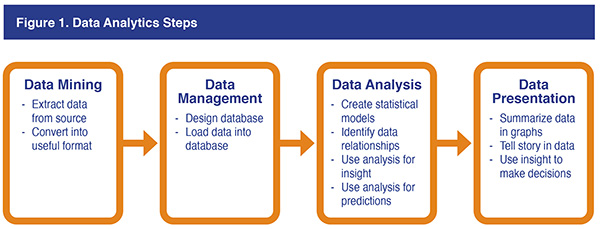

As shown in Figure 1, the data analytics process can be divided into four steps. The first step is called data mining and involves extracting data from a source and converting it into a useful format.

The second step is the data management or data warehousing step. This step usually involves designing a way to store the data so that it can be easily managed and retrieved.

The third step is the actual process of analyzing the data for insight and predictability. The final step involves presenting the data, as well as the insight to assist decision-makers in the decision-making process.

The data analysis step of data analytics consists of three main processes, which include:

1) Descriptive Analytics,

2) Advanced Analytics, and

3) Automated Analytics.

Descriptive analytics is very similar to what used to be called business intelligence, in that past activity, such as sales, expenses and product mix, are summarized in charts and graphs to explain what has already happened and tries to identify if there are any patterns.

Advanced analytics uses statistical and other analytical tools to explain either why things have happened in the past or what may happen in the future based on prediction or discovery of trends.

Automated analytics takes the advanced analytical tools and automates the analysis using machine learning techniques.2 Advanced analytics can be divided as follows:

1) Diagnostic,

2) Predictive, and

3) Prescriptive.

Diagnostic analytics attempts to explain the past behavior of the data being analyzed. Why have sales been higher in some months and lower in others? Have sales gone up when more money has been spent on marketing? Has raising prices in the past reduced sales volume?

Predictive analytics uses the past behavior of the data to predict future outcomes. If marketing expenditures are doubled, sales will increase by x%. If sales price is increased by x%, then sales volume will decrease by y%. If price is discounted by x%, then sales volume will increase by y%. Predictive analytics assists in decision-making by quantifying a decision's impact.

Prescriptive analytics attempts to identify the best course of action based on the data analyzed. Will revenues be maximized by increasing marketing expenditures or using that money to discount the price? Prescriptive analytics allow decision-makers to determine the best course of action in the face of uncertainty.

Data Analytics’ Impact on Business

Data analytics enables businesses to turn the data they have collected from their operation and their customers into information they can use to improve the process of making decisions. “It [data analytics] is used in a number of industries to allow the organizations and companies to make better decisions, as well as verify and disprove existing theories or models.”3

Improved decision-making from data analytics is expected to have a profound impact throughout the departments of businesses. Three areas that will especially have a significant impact are marketing, operations and innovations. “The benefits of using data analytics to drive decisions can impact every aspect of your business, including operations, marketing and product.”4

Marketing

Marketing is all about making prospective customers aware of the business’ products or services and creating an image of that business through branding. Any data that can be used to gain an understanding of that audience will make the marketing efforts that much more effective.

Successful marketing is more than just catching a customer’s attention. Studies and data have shown that the most successful marketing efforts stem from building a relationship with customers and creating meaningful brand awareness, which is done by working to understand what customers want to see and hear.5

In addition, data analytics can provide the level of detail that would allow a business to better understand their existing customers so that advertisements can be targeted to a specific segment of their customer base.

Operations

Data analytics provides businesses with information that enhances their understanding of all aspects of their operations. Data on inventory/warehouse management, logistics, pricing/sales strategies, supply chain, and predicting product demand enable businesses to make decisions that improve operations in a holistic manner that maximizes operational efficiency.

Data analytics can also help identify other potential opportunities to streamline operations or maximize profits. By identifying potential problems, it eliminates the process of waiting for them to occur and then taking actions. This allows companies to see which operations have yielded the best overall results under various conditions, identify which operational areas are error-prone and which areas need to be improved.8

UPS used data analytics to reduce fuel consumption for their drivers that resulted in a savings of 10 million gallons of gas.9

CPA firms have an opportunity to expand their business consulting services by providing operational analytics to small and medium-size businesses that do not have the resources or staff for analytics that are available to large businesses.

Innovations

Data analytics not only allows businesses to improve the decision-making for the way they are currently conducting business, but also allows businesses to gain insight for delivering new products and services. Using data to drive innovation will transform the business, as well as its products and relationship with customers.

Netflix used data analytics to create content that its customers wanted to watch resulting in sales increasing 36%.

T-Mobile used data analytics to transform its customer relationship and reduce churn by 50%. They matched social media data of their subscribers with CRM software and internal billing to identify loyal subscribers with high-lifetime-value to create a personalized retention campaign.10

Data Analytics and Public Accounting

The independent audit function is critical for the smooth functioning of the capital markets because it provides reasonable assurance that the financial statements of a publicly traded corporation are free of material omissions or misstatements. This independent verification on the accuracy of the financial statements reduces the risk exposure for investors and creditors.

Public accounting firms fulfill this function by performing audit procedures based on Generally Accepted Audit Standards that rely on professional judgement and an evaluation of the effectiveness of internal controls. “The traditional audit plan typically entails a series of preordered steps with the objective of addressing a series of audit assertions, relative to the value of assets and flow of resources.”11

The audit function as it exists today is a reflection of the evolving complexities of financial reporting and past expectations of the capital markets, regulatory entities, and society.

Opportunities and Challenges

As technology continues to evolve, data analytics promotes changes to business models and surprises those who are unprepared. Businesses change their strategies and the way that they operate. New threats and opportunities arise. In an increasingly data-driven world, CPAs need to be able to adapt to these technological disruptions.12

The potential impact of data analytics on the audit process is even greater because it can make audits more effective and efficient, and risks easier to assess. Audit data analytics methods can be used in audit planning and in procedures to identify and assess risk by analyzing data to identify patterns, correlations and fluctuations from models. These methods can give auditors new insights about the entity and its risk environment and improve the quality of the analytical procedures in all phases of the audit.13

One of the most significant challenges to the audit profession in incorporating data analytics is the audit standards. The audit standards, which have served the profession very well, were developed before data analytics and therefore are not integrated into the audit process. “In general, the auditing profession is governed by standards that were conceived some years ago and that did not contemplate the ability to leverage big data.”14

The other significant challenge is ensuring that accounting professionals start their careers with a skill set that allows them to effectively incorporate data analytics into their thought process and work requirements as they plan and complete audits.

“The human element of data analytics is the most critical factor,” said Roshan Ramlukan, EY principal and global assurance analytics leader. “But it’s also the least understood and an impediment to further growth in this area. Leaders must also recognize that analytical skills must be developed in all of their people, not just a few data analysts.”15

The Automated Audit

The American Institute of CPAs (AICPA), in its white paper titled “Reimagining Auditing in a Wired World,” asked the simple question “How would financial statement audits be designed if auditing were a new service that had just been invented?”16 The white paper concluded that existing audit standards needed to be modified to incorporate data analytics, auditors should be encouraged to use technologies that increase audit assurance and that the audit process needs to take a “quantum leap” to redesign the audit process away from legacy audit plans and incorporate the latest technologies.

Sample-based testing is one area that is expected to change. Data analytics and big data will allow auditors to incorporate all of the financial data of a company and evaluate it for patterns associated with potential errors and fraud.

Big data is a term used to describe the large volume of data that a business collects in the course of its operation. The transformed audit will expand beyond sample-based testing to include analysis of entire populations of audit-relevant data.17

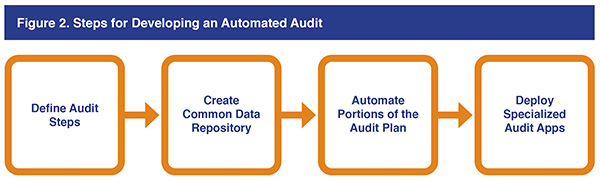

The concept of the automated audit is made possible as a result of data analytics and machine learning. Fundamentally, the automated audit will transform the audit plan into a control program with defined points to enhance the assurance function.

This will result in audits of the future being computer systems focused on extracting data, formatting it and storing it in a way that specialized audit apps will be able to analyze and summarize the data. Please see Figure 2.

“The modular audit, supported by data organized using Audit Data Standards (ADS), will transform the audit plan into a control program that uses a mix of manual methods, automated modules and defined decision points to improve the assurance function in an evolutionary (not revolutionary) path.”18

Changing Business Environment

The accounting profession is facing a challenging time as new technologies are changing the business environment. Auditing is a critical function in ensuring the smooth functioning of the capital markets and the economy.

Data analytics is having a significant impact on businesses and consequently it will also have a profound impact on auditing. The profession has taken an active role in adopting new technologies to enhance the audit function. There are many challenges, including updating auditing standards and procedures, as well as ensuring that accounting professionals have the technical knowledge and training to utilize the insight gained from incorporating data analytics into the audit function.

The opportunities for public accounting to deliver better services and greater level of confidence is unparalleled in the history of the profession.

About the Authors

Izhar Haq has a B.S.E.E in Computer Engineering from the University of Miami, Masters in Accounting from Nova Southeastern University, MBA from Indiana University – Bloomington, and Ph.D. in Accounting from Florida International University. He is Director, School of Professional Accountancy at Long Island University and has accounting experience in multinational corporations, as well as governmental and not-for-profit entities. Contact him at Izhar.Haq@liu.edu.

Sarah Hinchliffe has a Bachelor’s of Law from Monash University, an M.S. in Accountancy from University of Akron, and a Ph.D. in Law from Victoria University. She is an Adjunct Professor at Long Island University and has experience as an attorney, academic and scholar. Contact her at Sarah.Hinchliffe@liu.edu.

Christopher Bates has a B.A. and M.S. in Criminal Justice from Long Island University. He is Interim Dean-Long Island University’s College of Management and Brooklyn SBPAIS. He has experience on Wall Street and is a former member of the New York Stock Exchange and Managing Director at Goldman Sachs. He is pursuing his Doctor of Education at Northeastern University. Contact him at Christopher.Bates@liu.edu.

Footnotes

1 “What is Data Analytics?” Lotame, 2019, https://www.lotame.com/what-is-data-analytics/

2 “What is Data Analytics?”Master’s in Data Science, https://www.mastersindatascience.org/resources/what-is-data-analytics/

3 Avantika Monnappa, “Data Science vs. Big Data vs. Data Analytics,” simplilearn, 2019, https://www.simplilearn.com/data-science-vs-big-data-vs-data-analytics-article

4, 9, 10 Martin Gontovnikas, “How Data Analytics Can Transform Your Business,” Auth0 Blog, 2017, https://auth0.com/blog/how-data-analytics-can-transform-your-business/

5 Marianne Chrisos, “3 Major Impacts of Big Data Analytics in Marketing Organizations,” Tech Funnel, 2018, https://www.techfunnel.com/martech/impact-of-big-data-analytics-in-marketing-organizations/

6 “Types of Marketing Analytics,” PPC Expo Blog, https://ppcexpo.com/blog/types-of-marketing-analytics

7, 8 Anshita Solanki, “How Data Analytics Can Be Leveraged for Business Benefits,” Softweb Solutions, 2018, https://www.softwebsolutions.com/resources/leverage-data-analytics-for-business.html

11, 18 Mikos A. Vasarhelyi, Donald Warren Jr., Ryan A. Teeter, and William R. Titera, “Embracing the Automated Audit,” Journal of Accountancy, 2014, https://www.journalofaccountancy.com/issues/2014/apr/automated-audits-20127039.html

12, 15 Norbert Tschakert, Julia Kokina, Stephen Kozlowski, and Miklos Vasarhelyi, “The Next Frontier in Data Analytics,” Journal of Accountancy, 2016, https://www.journalofaccountancy.com/issues/2016/aug/data-analytics-skills.html

13 Maria L. Murphy and Ken Tysiac, “Data Analytics Helps Auditors Gain Deep Insight,” Journal of Accountancy, 2015, https://www.journalofaccountancy.com/issues/2015/apr/data-analytics-for-auditors.html

14, 17 “How Big Data and Analytics are Transforming the Audit,” Ernst & Young, https://www.ey.com/en_gl/assurance/how-big-data-and-analytics-are-transforming-the-audit

16 “AICPA White Paper "Reimagining Auditing in a Wired World"