Building the CPA Pipeline: A Faculty Perspective

Published: Sep 5, 2025

The CPA profession faces a shrinking pipeline, with fewer candidates entering the field even as demand grows. Faculty research highlights strategies to boost Exam success to better equip students, especially first-generation and future candidates under Texas’ new additional licensure pathway. Strengthening these supports is key to preparing the next generation of CPAs and securing the profession’s future.

By Judd Leach, Dr. Charles R. Thomas and Laura Gordey

The effects of the COVID-19 pandemic were many and widespread, but perhaps one of the most notable effects was what has become known as “The Great Resignation.” In 2021, 47.7 million workers quit their jobs, followed by 50.6 million workers in 2022.1 The accounting profession was not spared from this thinning of ranks; according to the Wall Street Journal, over 300,000 accountants quit the profession between 2019 and 2021.2 To put that number in perspective, there are currently fewer than 700,000 actively licensed CPAs in the United States.3

This precipitous drop in active CPAs, coupled with slow post-COVID growth in CPA candidates, has led many in the industry to declare that the accounting profession is facing a pipeline problem. A quick online search shows the pipeline issue is clearly top of mind across the profession.

The Pipeline Isn’t Dry, but It’s Not What It Once Was

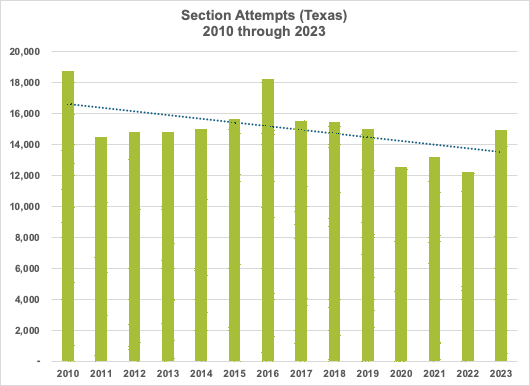

In 2023, we were the fortunate recipients of a research grant from the National Association of State Boards of Accountancy (NASBA). NASBA’s grant allowed us to take a deep dive into CPA Exam performance and participation trends in Texas over the last 20 years. We found that while the impact of COVID-19 on CPA candidate counts is hard to ignore, the drop in Exam attempts did not begin with the pandemic. Figure 1 shows the decline from 2010 levels.

Figure 1: Annual Exam Attempts, 2010 through 2023

Exam attempts hit a low between 2011 and 2015, rebounded in 2016, then dropped sharply again in 2017. Numbers continued to decline through the COVID years (2020–2022), with a brief bump in 2021. In 2023, attempts returned to pre-COVID levels but remained well below the peaks of 2010 and 2016.

So, if COVID-19 alone does not explain the drop in CPAs, what does? The answer likely depends upon whom you ask, but chances are you will receive one or more of the following responses:

- The workforce is aging and retiring;

- Low pay;

- The 150-hour requirement is too high for students;

- Students have negative perceptions about the return on their investment; and

- Professional burn out.4

Addressing these concerns will require effort from every corner of the accounting profession. From our perspective as business professors, however, we would like to address some strategies that can be taken to improve student success on the CPA Exam. We believe these strategies have both short- and long-term benefits for the accounting profession, irrespective of the pipeline issue.

Students Should Enroll in CPA Review Courses

The CPA path is a grueling one, ending with a notoriously tough exam. While coursework covers exam content, it’s spread over years. Review courses help students synthesize material, tackle complex questions, and gain new perspectives not always covered in class. Research generally supports the proposition that review courses correlate to greater success on the CPA Exam5 and by communicating this to students early in their accounting education, students can better prepare for the costs associated with those courses.

Encouraging students to take review courses is more important than ever due to two key factors set to shape the future CPA candidate pool. First, over half of all undergraduate students in the United States are first-generation college students, a number that continues to grow.6 These students have as much potential as their peers but often lack the support and guidance to navigate college and licensure.

Second, Governor Greg Abbott recently signed Texas Senate Bill 262 into law. The new law, which takes effect on August 1, 2026, creates an additional pathway to the traditional 150-hour CPA licensure track that requires only a bachelor’s degree with an accounting concentrarion and two years of work experience.7 Review courses will help students who elect this new pathway compensate for the lack of upper-division coursework required under the traditional track.

Students Should Consider the Timing of Exam Section Attempts

It should come as no surprise that some schools’ graduates perform better on the CPA Exam than other schools. In Texas, the highest-performing schools tend to be the large public universities and larger private universities. The lowest-performing schools tend to be smaller, regional universities, both public and private.

The data we analyzed through our NASBA-funded research showed that high-performing schools tended to remain high performing over the approximately 20-year period we studied, while lower-performing schools tended to remain low performing. In our research, we discovered some Exam timing trends that appear to separate high-performing schools from lower-performing schools.

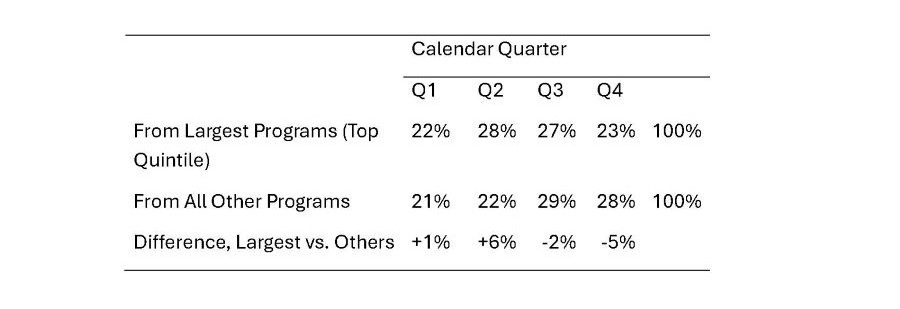

As depicted in Table 1, Texas CPA candidates from the largest accounting programs tend to make most section attempts on the CPA Exam during the second and third quarters of the year. Candidates from smaller accounting programs, in comparison, tend to make most section attempts during the third and fourth quarters of the year.8

Table 1: Texas Candidate CPA Exam Attempts

Course Mapping

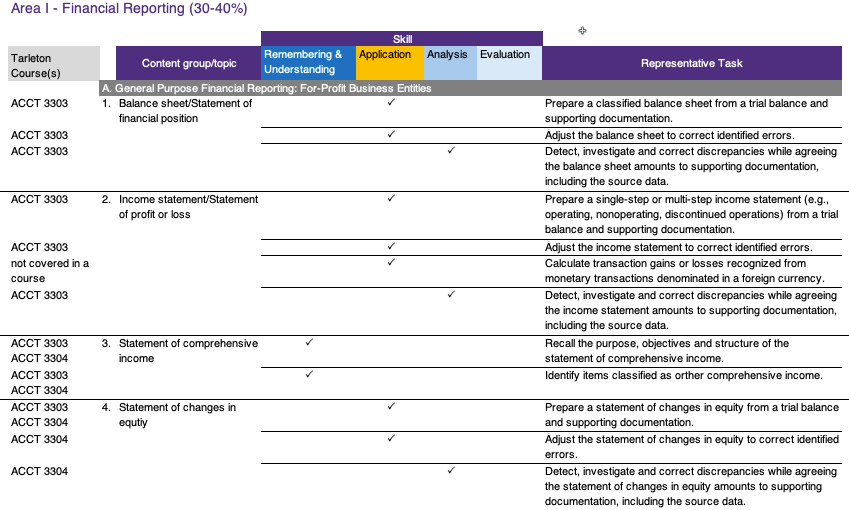

Students must satisfy the coursework requirements established by the Texas State Board of Public Accountancy to sit for the CPA Exam.9 Accounting programs in Texas design their curricula to satisfy these requirements, of course, but more can be done to help students understand how their courses relate to the topics that are tested.

AICPA publishes Uniform CPA Examination Blueprints that describe the content, skills and tasks CPA candidates will face on each section of the CPA Exam.10 The Blueprints are valuable to students by themselves, but they can be made even more useful if accounting programs map their accounting curriculum to the Blueprints.

Course maps show how each class connects to CPA Exam content, helping students and instructors plan effectively. Since exam sections can now be taken before finishing all coursework, maps also guide students on which classes to take first.

Finally, course maps identify topics not covered in the curriculum, so students know what they’ll need to study on their own. See Table 2 for a partial map of the AICPA Blueprint for the FAR Section of the Exam to accounting courses.

Table 2: Partial Map of the AICPA Blueprint

Collaborative Solutions for a Stronger CPA Pipeline

There is no single, easy solution to the challenges currently facing the accounting profession. Ultimately, overcoming current challenges – and the challenges that will invariably arise in the future – will require the concerted efforts of both educators and practitioners.

The proposals described here are just a few of many steps that we as educators can implement to improve the likelihood that accounting students will succeed on the CPA Exam. We hope to continue to analyze the data we obtained through our NASBA-funded research to find other ways to help prepare the next generation of CPAs.

Benefits to Students and Candidates TXCPA offers outstanding benefits to students and candidates. Go to the Become a CPA section on our website to learn more. |

Boosting CPA Exam Success: Key Strategies Encourage Review Courses

Promote Smart Exam Timing

Use Course Mapping

|

About the Authors: Judd Leach is an Associate Professor of Business Law at Tarleton State University who combines legal expertise with a passion for making complex concepts accessible to business students. His focus is on business law and contract principles, aiming to prepare students to apply legal knowledge confidently in their careers.

Dr. Charles R. Thomas, Professor of Accounting at Tarleton State University, is a highly experienced scholar-practitioner blending academic rigor with industry expertise. His work spans accounting systems, managerial costing, risk analytics, and complexity science, and he brings this wealth of knowledge to both classroom instruction and executive development programs.

Laura Gordey is an Associate Professor of Business Law at Tarleton State University, committed to helping business students understand the real world impact of the legal system. Her research interests include white collar crime and workplace legal issues, with a strong focus on supporting business students, particularly those aspiring to become future attorneys and CPAs, in achieving their professional goals.

Footnotes

2. https://www.wsj.com/articles/why-so-many-accountants-are-quitting-11672236016

3. https://nasba.org/licensure/howmanycpas/

4. https://www.kiplinger.com/taxes/the-cpa-shortage-problem

5. Shin, H., Lacina, M., Lee, B. B., & Pan, S. (2020). Schools’ CPA review course affiliations and success on the uniform CPA examination. Journal of Accounting Education, 50, 100642.

6. https://www.forbes.com/advisor/education/online-colleges/first-generation-college-students-by-state/

7. https://capitol.texas.gov/tlodocs/89R/billtext/html/SB00262I.htm

8. Second quarter 2004 through first quarter 2003, exclusive of quarters adjacent to 2010-11 and 2017 Exam updates.

10. https://www.aicpa-cima.com/resources/article/learn-what-is-tested-on-the-cpa-exam

Thanks to the Sponsors of Today's CPA Magazine

This content was made possible by the sponsors of this issue of Today's CPA Magazine:

Topics: