January-February 2024

FEATURED ARTICLE

Portability - Take a Closer Look with the 2025 Sunset on the HorizonWhen a client’s spouse dies, the client is likely overwhelmed. And although no federal estate tax return is required by the tax laws to be filed for a deceased spouse, it does not necessarily mean that one should not be filed anyway. In some cases, it is appropriate to file a federal estate tax return to transfer the deceased spouse’s unused federal estate tax exclusion to the surviving spouse.

Handling an Estate with S Corporation Stock

Handling an Estate with S Corporation Stock

It is prudent to revisit the Code and Regulations whenever working on an estate where the decedent owned S corporation stock at death so as not to inadvertently terminate the corporation’s S status. This article provides a high-level overview and reference tool covering the practical, procedural and timing matters applicable to estates and testamentary trusts that typically arise during an estate administration.

Artificial Intelligence Offers Turbo-Charged Solutions

Artificial Intelligence Offers Turbo-Charged Solutions

The business world in general and the accounting profession specifically is front and center when it comes to seeking ways to harnessing the artificial intelligence. AI is increasingly being employed to automate business processes.

Looking Ahead to 2024

Looking Ahead to 2024

We hope you had a healthy and prosperous 2023, and we look forward to helping you reach your goals in 2024! TXCPA is committed to bringing you resources, information, and connections to help you position your business and your clients for great success this year.

CPE Article: Recent Developments in Foreign Bank Account Reporting

CPE Article: Recent Developments in Foreign Bank Account Reporting

When a client shares that they have foreign activity, the immediate reaction of CPAs can be one of anxiety about adding more reporting requirements to domestic filing obligations. In this article, one particular reporting requirement is explained to assist in remediating some of the unknowns surrounding foreign reporting, specifically the Report of Foreign Bank and Financial Accounts (FBAR).

CPA Pipeline Issues Front and Center as TXCPA's Advocacy Efforts Continue

CPA Pipeline Issues Front and Center as TXCPA's Advocacy Efforts Continue

The 2023 session of the Texas Legislature was a success for TXCPA and our efforts to address CPA pipeline issues. From allowing students to begin to take the CPA Exam after completing 120 semester hours to helping pass legislation to expand the Texas State Board of Public Accountancy scholarship program, TXCPA’s advocacy will have a beneficial effect on the CPA pipeline.

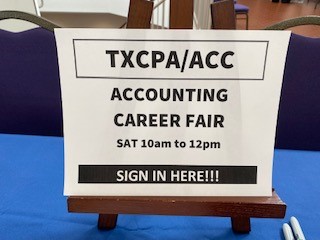

What’s Happening Around Texas: Month of Service and Career Awareness

What’s Happening Around Texas: Month of Service and Career Awareness

In What’s Happening Around Texas, we give you highlights of events and activities happening around the state in the TXCPA chapters. TXCPA's Accounting Opportunities Month, held in conjunction this year with our annual Month of Service, showcased the remarkable dedication of members in making a meaningful impact in your communities.

For TXCPA Member Arturo Machado, the CPA License Unlocks Trust and Credibility

For TXCPA Member Arturo Machado, the CPA License Unlocks Trust and Credibility

TXCPA member Arturo Machado is a shareholder at Sol Schwartz & Associates. His commitment to professional development and community engagement is shown by his service on the TXCPA Leadership Council, and active involvement in leadership roles and chapter activities within TXCPA San Antonio.

The Fundamentals of Value Pricing

The Fundamentals of Value Pricing

Pricing for profit is critical to the health and success of your business. When you set your prices correctly, you gain a significant edge over your competitors. So, how do you set your prices correctly in today's economic environment?