July-August 2023

FEATURED ARTICLE

Private Company Accounting Alternatives and Practical ExpedientsFASB established the Private Company Council (PCC) to address accounting concerns associated with private companies. This article discusses the accounting alternatives and practical expedients that have been issued as a result of the joint effort between FASB and the PCC to address private company accounting concerns and when recognition and measurement differences exist between public and private companies.

- Volunteer

We started the new 2023-2024 year off with celebrations and thoughtful collaboration at the Annual Meeting of Members in Fort Worth. Part of the work done at the Annual Meeting was focused on launching our strategic planning process. Here are some of the ways you can chime into what we’re doing at TXCPA.

By By TXCPA Chair Tim Pike, CPA-Dallas, CFE

Understanding the Employee Retention Tax Credit - Preparing Against the Risk of IRS Audit and Tax Litigation

Understanding the Employee Retention Tax Credit - Preparing Against the Risk of IRS Audit and Tax Litigation

In response to the economic consequences of the COVID-19 pandemic, Congress introduced a series of relief measures, including the Employee Retention Tax Credit (ERC). As tax and legal professionals navigate the complexities of this credit, it is crucial to understand its application, eligibility criteria, tax treatment and the implication of Circular 230, among other issues.

By Juan F. Vasquez, Jr., Victor J. Viser and Tania Albuja

Value Creation and Opportunities for CPAs on the Metaverse

Value Creation and Opportunities for CPAs on the Metaverse

Metaverse can be seen as the next evolution of the Internet, where users will enjoy a new and different level of experience as they meet people virtually and interact and conduct business in this environment. As CPAs and business advisors for our clients, we need to familiarize ourselves with this term, how this virtual environment can add value and how CPAs should leverage this technology.

By Derrick Bonyuet, Ph.D., CPA, CFA, CFP

A Review of the 88th Session of the Texas Legislature - It’s a Wrap For Now

A Review of the 88th Session of the Texas Legislature - It’s a Wrap For Now

Although the 88th session of the Texas Legislature ended with a whirlwind of unfinished business, TXCPA accomplished two enormous legislative wins in the session. Senate Bill 159 was passed, which allows students to take the CPA Exam after completion of 120 semester hours and 21 hours of upper-level accounting. Another bill TXCPA advocated for, House Bill 2217, was also passed. It will expand TSBPA’s fifth-year scholarship program.

By Kenneth Besserman, JD, Director of Government Affairs and Special Counsel

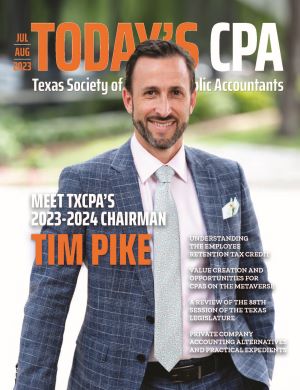

Meet TXCPA's 2023-2024 Chair Tim Pike, CPA, CFE, CGMA

Meet TXCPA's 2023-2024 Chair Tim Pike, CPA, CFE, CGMA

TXCPA President and CEO Jodi Ann Ray, CAE, recently connected with 2023-2024 TXCPA Chair Tim Pike, CPA-Dallas, CFE, CGMA, to talk about his journey as a CPA and how volunteer service has enriched his life. You’ll learn more about his personal career path, how TXCPA is working to address the shrinking CPA pipeline and how his running habit helps him problem solve.

By Jodi Ann Ray, CAE, TXCPA President and CEO

Accounting Industry Outlook - Trends in Organizational Culture and Other Issues Impacting the Profession

Accounting Industry Outlook - Trends in Organizational Culture and Other Issues Impacting the Profession

What is the most important intangible element of your business that sets you apart from every other business in the world? Organizational culture should be right at the top of the list. This spring, TXCPA continued our series of research surveys designed to examine the accounting industry outlook and we discovered some interesting trends related to organizational culture and other far-reaching issues.

By By DeLynn Deakins, Today’s CPA Managing Editor