July 01, 2021

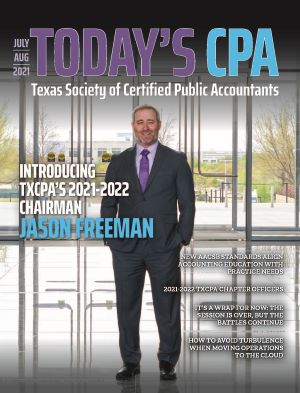

TXCPA Chairman Jason Freeman

TXCPA’s Incoming Chairman Jason Freeman, JD, CPA-Dallas, began his term in June when TXCPA kicked off the 2021-2022 Society year. As a CPA, trial attorney, law professor and author, Freeman is the founding and managing member of Freeman Law, PLLC, which is based in the Dallas-Fort Worth Metroplex. Bringing enthusiasm, an entrepreneurial spirit and commitment to his profession, he’s excited about his new role as Society chairman.

Q. You started your own firm before the age of 35. You also serve on the law school faculty at SMU’s Dedman School of Law, where you have taught a course in federal income taxation. Why did you choose the accounting profession and tax law?

A. Funny enough, I knew I wanted to be a lawyer from the time I was a young kid. I wanted to be a trial lawyer. I didn’t have any lawyers in the family, and I’m not sure how or why I knew that – but I definitely did. I became drawn to accounting later in life, in college. I found my intro course in accounting to be very interesting and challenging. Over time, I saw how I could really meld the two together and leverage accounting expertise through the law.

As far as starting a firm and serving as a law professor, I’ve always been entrepreneurial and enjoy challenging myself. They were both opportunities to grow and to push beyond my comfort zone.

Q. Tell us about your law firm. Have you always practiced in this area of the profession?

A. I founded our firm with a central goal and philosophy: To leave the world and our clients better than we found them. We have an amazing group of talented professionals on our team.

From the beginning, my practice revolved around tax and financial litigation, with a heavy focus on accounting and tax issues. Many of our firm’s cases are against the government. I view that role as an important one: Serving as a check on government. I view my role as trying to resolve disputes and protect my clients – sometimes that involves working closely and cooperatively with the government or the other side, sometimes that means taking them on aggressively.

Q. What is the most rewarding part of your career and the most challenging?

A. The most rewarding aspect is righting wrongs and resolving disputes. And sometimes, if you’re lucky, it’s changing lives. Not many things are better than that. I love challenges. The more difficult the case, the more interested I am. I don’t deal with a lot of cookie-cutter problems. It’s a new set of issues and facts with every case. So I’m always evaluating my thought processes and thinking through whether I’m applying the right tool to the problem.

Q. What are your passions other than accounting and the law?

A. I truly love music and the piano. I became a bit obsessed with the piano during my college years and it’s a passion that stuck with me. It’s one of those things that I use as a stress reliever. I was completely self-taught and really got engulfed in the theory of music – down to the fundamental physics of it all. I use it as a bit of an escape.

Q. Tell us about your personal life and interests. What do you like to do when you’re not working?

A. If I could be doing anything, it would be just hanging out with my wife Laura and my family. I’ve got three young kiddos: Gia, Chloe and Beckett. Our world revolves around them. I also love to get out to the ranch whenever I can. I have a ranch down in central Texas that has been in the family since the 1800s. That is one of our favorite getaways, a place that really helps recalibrate the world and keep things in perspective.

Q. How has the accounting profession been transformed over the past year as a result of the worldwide pandemic?

A. We have just been through one of the most transformative years in history. I think it forced us to confront what’s possible and what we’re capable of. In the long run, I personally think it will give rise to a renewed emphasis on company culture and how we cultivate the right environment for employees. I also think it placed an emphasis on collaboration and transparency. The past year spurred innovation and, just as important, an innovative mindset. That is something that the accounting profession will need to embrace.

Q. What issues will TXCPA and the accounting profession face in the next several years?

A. We’re moving into a future that will place more and more value on consulting, critical thinking and analysis, and professional judgment. The profession will need to arm CPAs with technological know-how, but also mental frameworks and critical-thinking skills that help us solve the day-to-day problems.

Given the events of this past year, one immediate threat that the profession faces is burnout and the state of morale. That translates into workforce challenges. For many people, the concept of a work-life balance fell by the wayside during the pandemic. People were running on adrenaline for months on end.

Q. What opportunities do you see coming from the CPA Evolution Project, both for TXCPA and for future CPAs?

A. With NASBA and AICPA moving towards a new licensure model, there are opportunities for TXCPA and the profession to shape and define the role of the CPA in the future. For TXCPA, I think it’s an opportunity to expand our offerings and to expand the ways that we can provide value. The CPA of the future will need to be a “meta” thinker; we’ll need to emphasize problem-solving, systems thinking and professional judgment. The reality is that the landscape has changed over the past few decades. There are more accounting standards, pages in the tax code and administrative guidance than ever before. We’ll have to evolve in the way we think in order to meet the future demands of the profession.

Q. TXCPA launched a new strategic plan in 2020. What are you most excited to see come to fruition as a result of the work done under this new plan?

A. Look, I’m excited about everything in our strategic plan. But what I’m actually most excited about is the process that we went through – the thoughtfulness and deliberation, the teamwork, and the selfless commitment that so many hard-working members gave to put the process together, the way that it came about, and the passion and energy that so many people put into it working towards a common goal. I think I get more excited and rejuvenated by seeing that process than by any specific goals that come out of it.

Q. You have been involved with TXCPA and TXCPA Dallas as a volunteer leader. Why did you become a volunteer? How has your TXCPA service impacted your career?

A. Service with TXCPA has given me another work family. It’s exposed me to different ways of thinking, opportunities to lead and to follow, to learn and to teach. I originally got involved because I wanted to be part of the Federal Tax Policy Committee. Collaborating with all of the knowledgeable, first-rate folks on the FTP was a great experience. It made me better professionally and I developed a lot of close friendships.

Q. Like many associations, TXCPA is managing a demographic shift in membership with many long-time members and volunteers entering retirement and a growing group of new CPAs entering the profession. How do you think TXCPA and our chapters can proactively address this shift to remain relevant and engage a multi-generation profession?

A. We have, over time, seen a shift in the age demographics. They’ve skewed towards members with more longevity. I view that as a sign that members continue to see the benefit both personally and professionally, and they are working longer and retiring later. That’s a good thing. These members have been our lifeblood and I want to see them continue to be actively engaged. At the same time, of course, we need to engage the younger generations. They are our future.

As far as how we can address the shift, though, we can start by reframing our thinking. There’s always a tendency to define generations by their differences. But there are far more aspects in common among them than differences. So we can start by coming at it from that perspective. Thinking that way opens up many more opportunities. And rather than viewing the shift as an inherent problem, we can see it as an opportunity. If we fundamentally change how we view it, we’ll get fundamentally different results.

Q. What advice would you give students interested in becoming a CPA?

A. Do it. It was one of the best professional decisions that I ever made and helped define my career. I’m a case-in-point example that there are many paths and ways to use the CPA skillset. The CPA designation is, in my opinion, not about numbers or auditing standards or tax code sections. It signifies something else: trust and integrity. That is what people see when they see those letters next to your name. And they are the most valuable traits one can have in virtually any line of professional work.

As the world becomes more decentralized and technology driven, those traits are going to take on greater, not lesser, significance. They provide keys to success in almost any career path you choose.

Interesting Facts About Jason Freeman, JD, CPA

• While he did not grow up planning to become a CPA or an accountant, he says it is one of the best professional decisions he ever made.

• He was a column editor for the Tax Issues column in Today’s CPA magazine.

• He has a deep appreciation for music and plays the piano.

• He entered college as an athlete playing baseball.

• He is part of the law school faculty at SMU’s Dedman School of Law.

• He has been recognized multiple times by D Magazine, a D Magazine Partner service, as one of the Best Lawyers in Dallas.

• He has been recognized as a Super Lawyer by Super Lawyers, a Thomson Reuters service.

• He was honored by the American Bar Association, receiving its “On the Rise – Top 40 Young Lawyers” in America Award.

• He has been recognized as a Top 100 Up-and-Coming Attorney in Texas.

• He was named the “Leading Tax Controversy Litigation Attorney of the Year” for the State of Texas by AI.