Accounting and Tax Implications of Crypto Assets

By Josef Rashty

Accounting literature defines cryptocurrencies broadly as digital records, which use cryptography for verification and security purposes on a decentralized distributed ledger (blockchain). The Financial Accounting Standards Board (FASB) does not have any standards on cryptocurrencies; however, Topic 350, Intangibles–Goodwill and Other, provides the accounting guidance for cryptocurrencies and thereby accounting literature addresses the common-known cryptocurrencies as crypto assets.

In December 2019, the American Institute of CPAs (AICPA) issued its nonauthoritative practice aid, Accounting for and Auditing of Digital Assets. The consensus from the AICPA practice aid is that companies should classify crypto assets, based on Topic 350, on their balance sheets as indefinite-lived intangible assets. (Generally, intangible assets lack physical substance and are not considered financial assets.)

Companies are increasingly accepting crypto assets for their payments, receipts or investments. This article explicates some of the accounting and tax implications of crypto assets. Its goal is not to enumerate a comprehensive list of accounting and tax issues related to crypto assets, but to familiarize readers with some fundamental GAAP and IRS concepts.

Initial Recognition

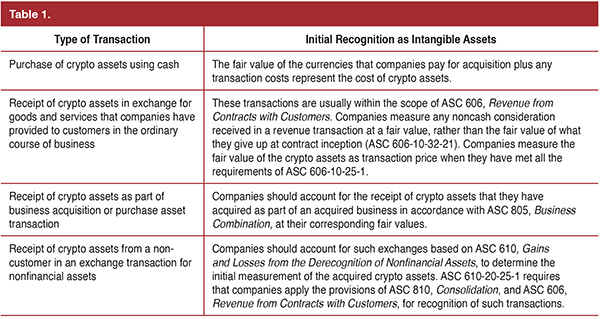

The schedule in Table 1 represents the initial recognition of crypto assets under several circumstances.

Classification

Companies should determine the useful life of their intangible assets as finite or indefinite life. The useful life of an intangible asset is indefinite if no legal, regulatory, contractual, competitive, economic, or other factors limit its useful life to the reporting entity. Crypto assets usually have an indefinite useful life and thereby accounting literature considers them as indefinite-lived intangible assets.

Companies do not amortize the indefinite-lived intangible assets. Instead, they test them for impairment periodically or upon a triggering event that indicates that it is more likely than not that the indefinite-lived intangible asset has been impaired. FASB provides guidance that companies should consider in assessing the impairment of their indefinite-lived intangible assets (ASC 350-30-35-18B).

Impairment

The impairment test under ASC 350 is a one-step test that compares the fair value of crypto assets with their carrying values. If the fair value is less than the carrying value, companies should recognize an impairment charge. Once companies record the impairment, they cannot reverse it even if the fair value of the crypto asset increases in the subsequent periods.

There would have been a different outcome if FASB had identified crypto assets as cryptocurrencies. (FASB requires that the fair value of any non-functional currency be adjusted – favorable or unfavorable – at the end of every reporting period in either other comprehensive income or statement of income depending on circumstances - ASC 830, Foreign Currency Matters.)

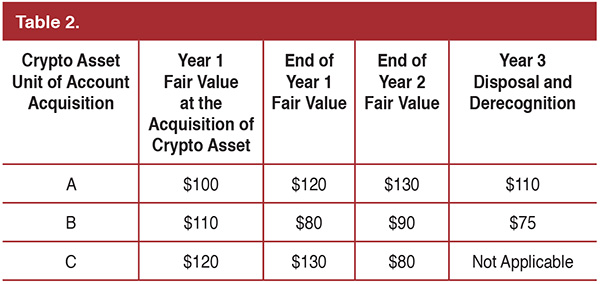

Companies acquire crypto assets in different transactions at different times. FASB considers each acquisition of a crypto asset as a separate unit of account for impairment testing purposes. Therefore, companies need to maintain different accounts for each acquisition of crypto assets to be able to keep track of their different cost bases. The example in Table 2 illuminates the above concept.

In this illustration, an entity acquires crypto assets in three different transactions in Year 1. These transactions are identified as A, B and C in Table 2 and each transaction is a different unit of account for accounting purposes.

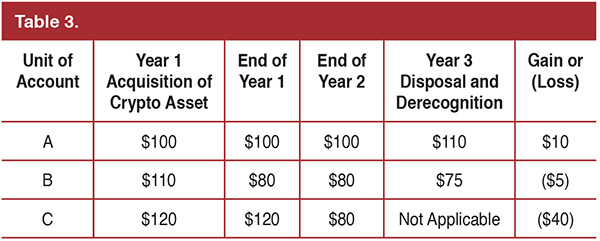

Crypto Asset A: A company records the crypto asset in Year 1 at $100 at the time of acquisition.

It does not record the favorable adjustment of $20 ($120 less $100) at the end of Year 1.

It does not record the favorable adjustment of $30 ($130 less $100) at the end of Year 2.

It records a $10 gain ($110 less $100) when it disposes of the crypto asset in Year 3.

Crypto Asset B: A company records the crypto asset in Year 1 at $110 at the time of acquisition.

It records the unfavorable adjustment of $30 ($110 less $80) in Year 1.

It does not record the favorable adjustment of $10 ($90 less $80) in Year 2.

It records a $5 loss ($75 less $80) when it disposes of the fixed asset in Year 3.

Crypto Asset C: A company records the crypto asset in Year 1 at $120 at the time of acquisition.

It does not record the favorable adjustment of $10 ($130 less $120) in Year 1.

It records the unfavorable adjustment of $40 ($120 less $80) in Year 2.

See Table 3 for the bases of crypto assets at the end of each reporting period.

Fair Value Measurement

ASC 820, Fair Value Measurement, establishes a framework for determining fair value. FASB defines fair value as the price that a company may receive selling an asset or pay to transfer a liability in an orderly transaction between the market participants (ASC 820-10-20).

Fair values have the following three-level fair value hierarchy:

Level 1: Quoted prices in active markets for identical assets or liabilities that companies can access at the measurement date.

Level 2: Observable inputs other than Level 1 inputs.

Level 3: Unobservable inputs.

ASC 820 gives precedence to observable over unobservable inputs. In most instances, companies can determine the fair value of crypto assets as Level 1. The Wall Street Journal includes market information in its Markets/Market Data/Currencies section. The information is available online at this link.

Tax Implications

The IRS provides guidance in Notice 2014-21, which was later supplemented by Rev. Rul. 2019-24. This guidance requires that companies treat crypto assets as properties rather than currencies and apply general tax principles applicable to property transactions to crypto assets.

Taxpayers can classify the crypto assets that they hold as business, investments, capital assets, or inventory. Some examples for the tax treatment of crypto assets include:

• Companies that receive crypto assets as payment for the goods and services that they deliver or provide include in their earnings the fair value of the crypto assets upon their receipts.

• Companies that exchange crypto assets for other properties incur gains on the exchange, if their adjusted bases in the crypto assets is less than the fair value of the property received or a loss if it is more.

• Companies that sell crypto assets that they hold generally recognize capital gain or loss upon the sale of their crypto assets.

• Companies that sell crypto assets that they hold as noncapital assets (e.g., inventory) generally recognize ordinary income gain or loss upon the disposition of capital assets.

• Companies that pay their employees’ wages in the form of crypto assets should include the fair value of crypto assets for payroll tax withholding purposes.

Mining

Mining is the process of creating new cryptocurrencies and bringing them into circulation by solving complex mathematical problems and it is a fundamental component of blockchain technology.

Cryptocurrency miners often require many sophisticated and powerful computers and the operation consumes a significant amount of electricity. The common belief is that since producing electricity usually relies on the burning of fossil fuels, the mining process has irreversible environmental footprint costs.

Companies that engage in mining activities credit their mining income account and debit the newly generated cryptocurrency assets in their books at fair values. They account for expenses, such as costs of electricity, and depreciation of capital assets, such as computers, throughout the operation. Similarly, for tax purposes, companies should reflect the fair value of the mined crypto assets in their gross income at the date of acquisition.

Controls

Companies should exercise their internal controls over financial reporting (ICFR) for their digital asset holdings similar to other categories of their assets on their balance sheets. However, there are certain peculiarities related to crypto assets that companies should consider on their ICFR for their crypto assets.

The peer-to-peer nature of blockchain transactions is designed such that it makes the reversal of transactions very difficult or impossible. This implies that once companies send transactions to a particular wallet address, they can no longer perform any adjusting blockchain entry. Thus, controls over the initiation and authorization of transactions are critical to avoid any erroneous transfer that may lead to the loss of crypto assets.

Digital assets are secured transactions using “private keys.” This means that there is an inherent risk that private keys could be stolen or lost. Therefore, companies need to maintain controls for proper storage and safeguard of their private keys.

Disclosures

Companies include general disclosures in their notes to financial statements for their crypto asset policies based on ASC 235, Notes to Financial Statements, and disclose risks and uncertainties associated with their crypto assets based on ASC 275, Risks and Uncertainties.

Furthermore, companies disclose the impairment of their crypto assets based on ASC 350, Intangibles–Goodwill and Other). Finally, the Securities and Exchange Commission (SEC) has additional considerations for registrants in its Regulation S-X for disclosures and subsequent events (also see ASC 855, Subsequent Events) that may apply to crypto assets.

Summary

FASB has not issued any guidance to address crypto assets’ accounting per se. However, based on existing GAAP guidance and AICPA’s non-authoritative literature, the prevalent practice is to consider crypto assets as indefinite-lived intangible assets.

Similarly, the IRS has treated crypto assets as properties and has made them subject to its rules for transaction of properties.

Companies that deal with crypto assets should provide accounting processes and systems to properly account for them as indefinite-lived intangible assets.

Furthermore, companies need to provide adequate controls to account for the safekeeping and proper use of their crypto assets to enable their board of directors to perform proper oversight. Companies also need to provide relevant disclosures in their financial statements.

The use of cryptocurrencies has been expanding at a rapid pace, and more and more companies accept them in their normal course of business. Therefore, the author believes that relegating the accounting issues on this subject to some existing standards may no longer suffice to convey the complexities of accounting and disclosure issues surrounding digital assets.

FASB and the SEC will eventually address the cryptocurrencies more comprehensively and will issue more specific guidance to provide a substratum to deal with the specific and emerging accounting issues of digital assets.

About the Author: Josef Rashty, CPA, Ph.D. (Candidate) is a member of the Texas Society of CPAs and provides consulting services in Silicon Valley, California. He can be reached at jrashty@josefrashty.com.