Special Report - Accounting Firms: Can Your Existing Talent Solve Your Workforce Shortage?

This special report supported by The Institute of Internal Auditors

By Mark Masson and Maggie Miller

Professional services firms in general, and accounting practices in particular, are in a significant staffing crunch. At a time when projects are becoming more complex, it may seem like your firm just does not have the capacity to take on more work.

Simultaneously, two-years plus into the pandemic, we increasingly see considerable risk of burnout. To compound the problem of long hours in the accounting profession, working from home brought expectations that people will work well into the night and weekends, and technology means they are expected to respond to clients and colleagues around the clock, seven days a week. At a certain point, even the most generous compensation packages bring diminishing returns, and firms are challenged to provide other meaningful incentives.

While the problem is evident, the solution is proving evasive. Firms have tried to hire more people. They have tried to supplement staff through technology and outsourcing. They have tried to improve the employee experience by implementing work from home or hybrid work models. But typically, they have emphasized one of these potential solutions, ignoring the fact that a multidimensional challenge like talent scarcity requires a multidimensional solution.

Multi-dimensional Staffing: What’s Possible?

Imagine a world where staffing does not unilaterally come from demand from your clients, but rather, a generous interplay between demand and supply from your talent pools. Too often, staffing tends to happen via a highly inexact process – basically, team members are placed on a project because of who they know, rather than what they know or want to do.

RELATED ARTICLES:Desirable Internships Lead to Successful Campus Talent Acquisition |

What if team members could have the highest level of visibility into their own skills, experiences and interests, and those of their peers, to “match” them with the right work opportunities through a digital interface? This provides a multidimensional solution by giving CPAs the ability to chart their own career paths. At the same time, it ensures that the firm can find qualified team members for projects and work opportunities.

A digital, dynamic solution like this can cast as wide or as targeted a net as a firm requires. For example, while most firms would likely balk at the idea of flying someone in from Australia to work on a short-term engagement in Houston, here in the age of telework there is no reason to let geography pose a barrier when trying to get the best-suited talent or specialized resources involved in a project.

Now, if you think firms can do this precisely today – with the current processes, technology and operating structures of most top 100 firms – you’ll be sorely disappointed. Talent experience and matching systems (“PSA technology solutions”), while available and a competitive market, often are not based on a deep enough understanding of what various types of work truly require, the preferences of candidates or what team structures have led to differentiated business outcomes.

Despite that, we can focus on directional guidance and still unlock massive insights into how talent and teams can be more effective for your firm.

The First Step to Multi-dimensional Staffing

Skills and work matching solutions can be put into place when you bring data and information on talent supply, work demand and requirements for successful matching.

Supply

Identifying your team members’ skills, experiences, preferences, availability and performance provide a holistic profile of their capabilities and potential contributions to different client projects. Most firms fall into a trap on this data, relying on its practitioners to input this data themselves or internal functions to translate CVs, resumes, publications and more into categorical variables. What if you skipped this step, and instead utilized information that you already have within your systems?

Many firms can utilize information about clients, industries and project types to have directional data on the skills, experiences and capabilities that team members have through their client-billable work. To get started, perform a simple analysis on how many of your team members have spent at least 20% (or 40% or 60%) of their billable hours in a single industry – might these team members be more experienced than a generalist resource for potential projects? Does this make you think differently about “expertise?”

Types of work, clients, engagement sizes, internal team sizes and configurations, and more can give you a sense of not only the capabilities each member of the team possesses but also the environments in which they thrive.

Demand

All firms have different practices and project types that are fundamentally different from each other; but not all firms deeply understand the differences between the work performed in one vs. another, and where there may be commonalities. For example, might there be very similar discovery work steps on a risk advisory project as a supply chain project?

As with supply, start by analyzing existing data on project work tasks or pro-forma project budgets. Seek to identify similar project execution pathways that can cluster similar types of work together in ways that maybe are non-traditional across industry or practice group lines. If your data isn’t robust enough to provide interesting insights, start with a pilot within an industry group or practice area to help team members code their time differently to get more effective data.

Matching

When the talent and demand data can be matched, data analysis and modeling can be used to unlock key insights that reveal the source of three common challenges among accounting firms today.

Promotions in Title Only. Across the industry, managers and senior managers are often the most over capacity and overly relied on role to do the work, creating high turnover and a lack of a robust future-partner pipeline. This is often because firms promote strong senior associates to managers based on their ability to complete complex parts of tax returns, audits or advisory workpapers independently.

When they become a manager, they continue to do these same work tasks, rather than transition the work to senior associates. In a more hybrid and virtual workspace, this will continue to happen without clear career transition events and expectation setting.

A matching analysis between staffing and demand will help identify where managers are being overly indexed on the preparation tasks, rather than on reviewing tasks.

Inability to Identify Fungible Talent. Anecdotally, we’ve seen three of the top 20 firms turn away client demand due to a lack of capacity within the practice team. Often, there is simultaneously excess capacity in other practices, and perhaps these same people have similar skill sets and experiences that could have applied to the client challenge. This talent mismatch becomes a significant business limitation, likely leaving hundreds of thousands of dollars on the table for large firms.

The matching analysis we suggest will help identify where excess capacity could be deployed for similar types of work, helping to buoy utilization, provide valuable learning experiences and perhaps even drive higher employee work satisfaction.

Over or Under Delivering for the Client. While all clients want best-in-class service, firms are at capacity and must be judicious with their client service model to deliver the optimal service for the situation. Most firms would argue that industry expertise is critical for the client experience, but this type of expertise may only be critical on certain types of work or clients – other projects and clients will be expertly delivered with more generalist resources.

A matching analysis between clients and staffing configurations will help reveal what’s most important for different types of clients and the work being performed. Do clients truly value higher levels of expertise on more routinized requests? Or does it actually over time make them skeptical of how efficiently you are delivering to their needs and in the process, keep your most experienced talent from solving higher order problems for them?

How Your Firm Would Benefit

What would it mean if you were able to staff projects in this way?

Increased productivity and utilization. When firms translate the work they do into codified data, they unlock significant potential for improving the way they work. Picture baking a cake: regardless of the ingredients, there is a common sequence that you use (preheat oven, stir dry ingredients, combine butter and sugar, etc.). If firms can codify the major work steps of the work they do, they can identify what skills are required for the work and how to be more fungible with the types of talent who can perform those skills.

Improved employee retention and people development. When your talent has the ability to put their skills and expertise to work in new and different ways, they receive more layered and diverse work experiences, the opportunity to work with new people, new challenges and exposure to new clients.

This sort of development process is especially critical with Millennials and Generation Zs in the workplace, as they seek out non-linear work paths that offer continuous learning opportunities and allow them to work in an agile fashion across different project types. This can result in increased retention because they do not feel the need to go elsewhere to find new and stimulating work.

Anticipate workforce planning needs. Ultimately, with a better understanding of what skills are most relevant for client needs, firms can stay ahead of the curve of their talent strategy. Firms can create a dynamic workforce planning capability to help hire key talent or find lateral hiring opportunities required for the future, before that future actually arrives.

A Critical Rethinking

The solution to a given accounting firm’s talent shortage may well already be present within the four walls of the business. That is, a better staffing process may well reveal that a sufficient baseline of talent is there and just needs to be matched with the right work.

These matches come about through a rethink of the firm’s work and talent base through a robust, data-enabled framework. How a firm adapts to a more agile way to think about its work and its people could make all the difference in its ability to win against its competitors during this critical crunch for talent.

About the Authors: Mark Masson is lead partner in the Professional Services practice of Lotis Blue Consulting and Maggie Miller is a principal at the firm. They can be reached respectively at mmasson@lbconsulting.com and mmiller@lbconsulting.com.

~~ ~~ ~~ ~~ ~~ ~~ ~~ ~~ ~~ ~~ ~~ ~~ ~~

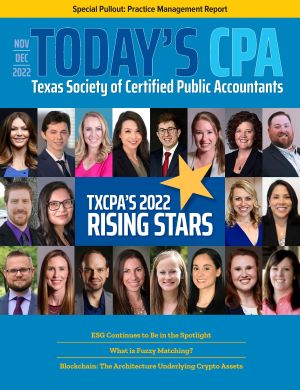

TXCPA’s Pipeline Strategy to Engage and Advance the Next Generation of CPAs

In 2022, TXCPA’s Pipeline Task Force developed a statewide strategy to guide our work to fill and strengthen the pipeline for future CPAs in Texas and measure the impact of our collective efforts to reach and engage the next generation of Texas CPAs.

The task force worked with TXCPA staff to develop a list of key stakeholders who have an impact on the CPA pipeline. They include:

- Candidates;

- College, high school, middle school and elementary students;

- Firms and companies; and

- Regulatory and legislative bodies.

To learn more about our pipeline strategy priorities for 2022-2023 and how you can get involved, please go to our website at https://bit.ly/FutureTXCPAs .