September 26, 2023

Corporate Transparency Act: Are You Prepared?

By Nathan George, CPA, and Ken Horwitz, CPA, JD, LLM

Congress has enacted a new, significant and pervasive compliance program: the Corporate Transparency Act (CTA). The CTA requires reports of beneficial ownership information (BOI) and is estimated to affect more than 32 million existing entities (even after exemptions). Initial reporting for existing entities will commence January 1, 2024, and must be completed before January 1, 2025.

This statute was enacted to combat “dirty money” issues such as tax evasion, money laundering and other financial crimes. Reporting will also be required for entities newly formed after January 1, 2024, within 30 days of formation.

It may be anticipated that lawyers who form entities after January 1, 2024, will file the initial reports for these entities. Any changes in the reported information (for existing entities or for entities formed after January 1, 2024) will require supplemental reporting within 30 days of such changes. Many, if not most, of the entities subject to these requirements will be clients of CPAs and will likely rely on their CPAs to prepare the initial and supplemental reporting for filing.

It seems clear that clients with non-exempt entities will need someone to monitor changes. Do not assume compliance will be simple. Reports will be filed with the Financial Crimes Enforcement Network (FinCEN), which is a bureau of the Department of Treasury. This is the same agency with which foreign bank account reports (FBAR) are filed. While the final rules for compliance and reporting obligations have been issued and timelines set, there are still many uncertainties, concerns and potential pitfalls regarding these new requirements. Penalties for failure to comply are onerous.

Clients will, for the most part, not be aware of these rules. In many cases, the lawyers who formed the entities may no longer be in contact with these entities, but CPAs will know who is required to report (or will know to whom inquiry should be addressed), if only because of preparation of tax returns and public information reports.

Now is the time for CPAs to start communicating with and preparing clients!

Summary of Provisions

What is a Reporting Company?

Reporting companies are those required to file reports with FinCEN and include two types:

- Domestic reporting company: a corporation, limited liability company or other entity created by the filing of document with the secretary of state (or similar office) within the United States.

- Foreign reporting company: a corporation, limited liability or other entity formed under the law of a foreign jurisdiction and registered to do business in the United States.1

Good News (for Some): Exclusions

Thankfully, there are many exceptions and categorical exemptions for entities that would otherwise meet the basic definition. These types of entities include (but are not limited to2):

- Large operating companies with at least 20 full-time employees, more than $5,000,000 in gross receipts or sales, and an operating presence at a physical office within the United States. (Note that there are many limitations and open questions regarding the scope of this and other exemptions; as one example, a subsidiary’s exemption does not imply that a parent or brother/sister company is also exempt);

- Banks or bank holding companies;

- Federal or state credit unions;

- Government entities;

- Entities with publicly traded securities or that already have reporting requirements with FinCEN;

- Insurance companies;

- Public accounting firms;

- Section 501(c) tax-exempt entities; and

- Certain types of inactive entities that were in existence on or before January 1, 2020 (date CTA was enacted)3.

Beneficial Owners and Company Applicants

If deemed to meet the reporting requirements, the company4 is obliged to identify and report its beneficial owners. Notably, guidelines provide a broad definition and require owners to be a natural person/human being.

Thus, if a company is owned by another company, one must look through to the person owning the parent company.

Overall, beneficial owners include those with:

- Substantial control;

- Indirect or direct ownership equal to or greater than 25%; or

- Company applicants.

What is Substantial Control?

Substantial control is based on a facts and circumstances analysis and is established regardless of ownership. This may take the form of board representation, ownership or control of the majority of voting rights or power of the reporting company, or by any contract, arrangement, relationship or otherwise. Per specific guidance, substantial control is established if the individual:

- Serves as a senior officer of the reporting company;

- Has authority to appoint or remove senior officers or board members;

- Had substantial influence over important decisions such as ability to merge or dissolve the company, control over major expenditures, or entry into or termination of contracts5.

Ownership Interest: 25% or Greater

Per the Final Rule, ownership interest includes (but is not limited to): equity, capital and profit interests, and “any other instrument contract, arrangement, understanding, relationship, or mechanism used to establish ownership6.” This may include joint ownership of an undivided interest in such ownership interest, through another individual acting as a nominee or agent, director ownership of stock, or ownership of membership interest7.

What is a Company Applicant?

For domestic entities, the company applicant would be the person who directly files entity-creation documents with the secretary of state (or similar office). For foreign entities, this would be the individual who first registers the entity to do business in any state.

Whether domestic or foreign, if more than one individual is involved, the applicant is “the individual who is primary responsible for directing or controlling such filing.”8

Required Information

Be advised: this will not be a quick “yes or no” type filing; a draft includes 50+ questions, including details about both the reporting company, as well as the beneficial owners and company applicants. FinCEN is developing a secure filing system by which information will be electronically reported via the organization’s website.

Regarding the company, required information will include:

- Legal name;

- Trade names or “doing business as” (d/b/a) names;

- Current street address for principal place of business (if foreign, current address from which U.S. business is primarily conducted);

- Jurisdiction of formation or registration; and

- Taxpayer identification number.

For beneficial owners and company applicants, the reporting company will have to provide:

- Individual’s name, date of birth, and address (which must be a residential address);

- Unique identifying number from an acceptable identification document, limited to:

- Non-expired driver’s license issued by a U.S. state;

- Non-expired identification document issued by a U.S. state or local government that is issued for the purpose of identifying the individual;

- Non-expired passport; or

- If the individual does not have any of the above, the identifying number from a non-expired passport issued by a foreign government.

- Name of state or jurisdiction where identification document was issued.

Effective Date: January 1, 2024

The effective date for the reporting program is January 1, 2024, but its impact will differentiate between existing versus new company. As noted, existing companies (i.e., those formed before January 1, 2024) will have from January 1, 2024, through January 1, 2025, to file a report but new companies (i.e., those formed on or after January 1, 2024), must file a report within 30 days of formation.

After the initial reporting, any changes to previously submitted information will require a follow-up report to be submitted in an egregiously short time (within 30 days of the date on which the change occurred). In the case of deceased beneficial owners, an updated report will be required within 30 days of the settlement of the decedent’s estate.

Penalties

The Final Rule provides both civil and criminal penalties for reporting violations, which may include:

- Willfully providing, or attempting to provide, false or fraudulent BOI, including a false or fraudulent identifying photograph or document;

- Willfully failing to report complete or updated BOI to FinCEN.

Civil penalties for such violations may include $500 for each day the violation continues, with criminal fines of up to $10,000 and imprisonment of up to two years.

Uncertainties and Considerations

An Aggressive Timeline and Lack of Awareness

First and foremost, an effective date of January 1, 2024, provides a minimal timeline for practitioners and reporting entities to plan. As noted in the exclusions above, with large operating companies (but not necessarily related companies) exempted (i.e., those more likely to have access to resources and information), the regulatory burden will largely fall on small business owners.

AICPA recently highlighted a number of major concerns, the least of which was the large lack of awareness of the new requirements, especially in the small business community.9 Despite the issuance of the Final Rule, there are (and will continue to be) questions regarding a number of issues.

Whose Responsibility?

Primary responsibility for reporting seems to provide a clear standard, but the business reality is often quite different. While new entities (post-01/01/2024) should be less of a concern for initial reporting, due to the opportunity to streamline the requirements into the current entity-creation process, the path for existing entities and follow-up changes is more complicated.

Often, legal teams file the initial setup paperwork with the secretary of state and over time, tax practitioners will file changes and updates. In such cases, you have different practitioners from different firms managing BOI information. Thus, potential areas of concern include:

- Who would be responsible for meeting reporting requirements?

- If a CPA signs or provides services, could it be considered unauthorized practice of law?

- Based on existing agreements, would such services fall within the scope of work?

Attribution and Constructive Ownership

Another concern is the potential lack of clarity with the attribution and constructive ownership rules in community property states. Per the final rule, direct or indirect ownership can exist “through any … arrangement … (or) relationship.” Thus, in the case of a married couple in a community property state, could a 100% interest by one spouse be interpreted as 50% ownership for each spouse? Or what if ownership is 40% by one spouse – does that mean each spouse is the beneficial owner of only 20% and falls below the reporting threshold?

Unfortunately, the guidance may not be as clear as the interpretation in the Final Rule: “… FinCEN considered whether further clarity is needed with respect to constructive ownership, or attribution – for example, by spouses, children or other relatives, by reference to other statutory or regulatory authorities such as the Internal Revenue Code or Office of Government Ethics rules – but determined that the terms 'ownership interest' and 'substantial control' are sufficiently comprehensive and other references were likely to be over-inclusive and create significant burdens on reporting companies.”10

Time and Cost Burden

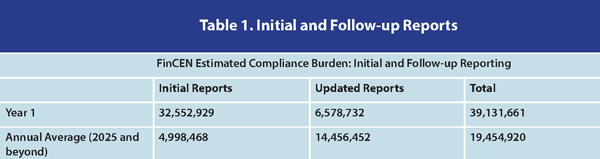

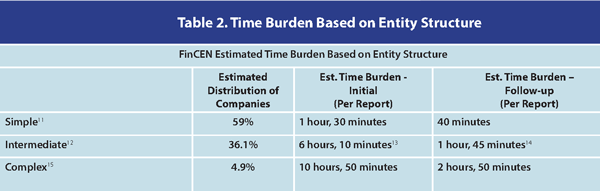

In addition to adapting to the still-evolving details of the program, the time required to comply will be substantial. As shown in Table 1 and Table 2, one cannot understate the compliance burden for initial and updated reports (Table 1) and based on entity structure (Table 2).

FinCEN estimates more than 32.5 million companies will be required to submit reports in Year 1. Importantly, and as noted above, any changes to BOI will require a follow-up report, an estimated 6.5 million in year 1 and 14.5 million annually for 2025 and beyond.

In Conclusion: Act Now!

The CTA reporting is a statutory requirement that is not going away. Given the reporting company obligations, practitioners should get up to speed and start planning at the soonest. Many current clients and their business structures will be affected and the reporting time (and resource) burden will be significant.

Ultimately, having the conversation and ironing out the details now will maximize the potential for success when the January 1, 2024, effective date arrives.

About the Authors:

Kenneth M. Horwitz, CPA, JD, LLM, is a Partner with the law firm of Glast, Phillips & Murray, P.C. in Dallas, Texas. Contact him at kmh@gpm-law.com.

Nathan S. George, CPA, is a Tax Manager with Condley and Company, LLP in Abilene, Texas. Contact him at nathan.george@condley.com.

Footnotes:

1 31 U.S. Code §5336

2 A full list of the 23 types of entities can be found at: https://www.fincen.gov/boi-faqs.

3 31 CFR 1010.380(c)(2)(xxiii).

4 Note that the reporting obligation falls on the company itself (e.g., via one or more of its officers).

5 31 CFR 1010.380(f)(8).

6 31 CFR 1010.380(d)(2)(i).

7 31 CFR 1010.380(d)(2)(ii).

8 31 CFR 1010.380(e)

9 https://www.aicpa-cima.com/news/article/coalition-calls-attention-to-new-beneficial-ownership-information-reporting.

10 31 CFR 1010.380. (https://www.federalregister.gov/documents/2022/09/30/2022-21020/beneficial-ownership-information-reporting-requirements)

11 Entities with one beneficial owner who is also the applicant.

12 Entities with four beneficial owners and two company applicants.

13 Per Notice, based on average of simple and complex totals.

14 Ibid.

15 Companies with eight beneficial owners, two company applicants.