May 10, 2024

Big Tax Relief in Texas

By Marvin J. Williams, MBA, JD, CPA, CMA, CFM, CGMA

Key Terms: Texas Property Tax Relief, Texas Franchise Tax Relief, Homestead Exemption, Budget Surplus

Texas often touts itself on being big and doing big things. This notion is fully evident in recent tax legislation passed by the Texas Legislature and signed by Governor Greg Abbott. The tax legislation resulted in the single largest tax relief in the history of the Lone Star State. It took two special sessions of the Texas Legislature to make this happen, but it indeed has happened.

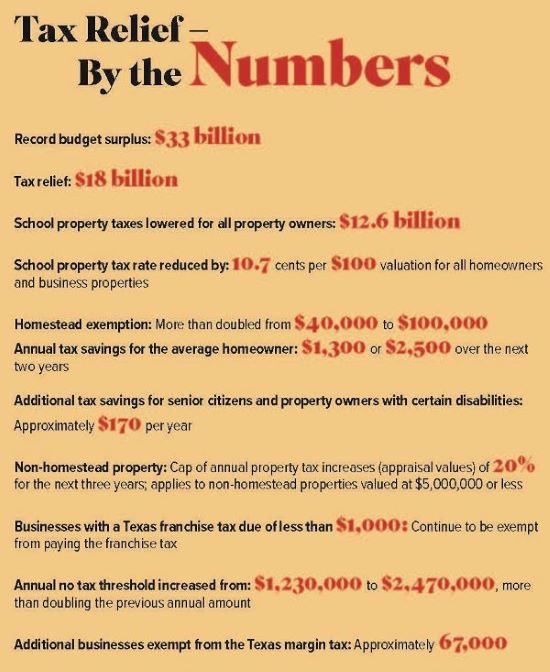

Governor Abbott announced during his reelection campaign and prior to the beginning of the 2023 biennial session of the Texas Legislature that he planned and pledged to sign into law the biggest tax relief in the history of the state of Texas. This bold assertion by the governor was fueled by Texas having a $33 billion surplus for the most recent budget period. This is the biggest budget surplus ever for the state.

For many years, Texas has proven to be a consistently good steward in the management of its financial resources. The state has a huge Rainy Day Fund that it has never dipped into. A solid Texas economy and very robust business culture have allowed Texas to generate substantial revenues to meet state appropriations. These consistent financial measures have allowed for such a very large budget surplus. Accordingly, the governor firmly believed that it is only appropriate to share this surplus with the taxpayers.

The leaders of the Texas Senate and Texas House initially could not reach agreements on how to return a large portion of this extraordinary surplus to residents. Different philosophies and alternate points of view were persistent in denying immediate agreements on the type of tax relief to give to taxpayers. The first regular session of the 2023 Texas Legislature ended without an agreement, with both parts of the legislature at strong disagreements. However, the governor was adamant on his pledge to taxpayers.

A special legislative session was immediately convened by the governor after the regular session ended. Both bodies of the legislature remained at odds on how to achieve tax relief, which at times became somewhat contentious and public. The first special session ended without an agreement.

The governor immediately convened a second special session. Through much debate and discussion, and perhaps less publicity, the bodies were able to reach a compromise and agree on the largest tax relief in state history. On July 22, 2023, the governor signed this legislation into law.

Although the legislation required voter approval in the November 7, 2023 general election (House Joint Resolution 2), its passage was a foregone conclusion. The legislation was overwhelmingly approved by voters. The new legislation went into effect for the most part on October 12, 2023 (although certain provisions took effect later in 2023 or beginning January 1, 2024, January 1, 2025 or January 1, 2027).

Property Tax Relief

The centerpiece of the $18 billion tax relief measure is property tax relief (Senate Bill 2 – Property Tax Relief Act). As in most states, Texas itself does not directly impose a property tax on property owners in the state. Property taxes are levied by local governments only (cities, counties, school districts and municipal utility districts (MUDs)). The levying of property taxes is often the major source of revenue for these local governments. For many years, Texas has had some of the highest property taxes in the United States. The property taxes that are imposed on property owners (individuals and businesses) are influenced by several factors, including the value of the property, the tax rate and

Annual no tax threshold increased from: $1,230,000 to $2,470,000, more than doubling the previous annual amount Additional businesses exempt from the Texas margin tax: Approximately 67,000 the exemptions (homestead and others) that are available to property owners. The Texas Legislature grappled with these factors in determining how to dramatically reduce the property tax burden of property owners.

In the tax relief package, $12.6 billion of the $18 billion goes toward lowering school property taxes for all property owners. The state will spend $12.6 billion to pay school maintenance and operation costs through the use of state sales tax revenues. The $12.6 billion payment will reduce (“compress”) the school property tax rate by 10.7 cents per $100 valuation for all homeowners and business properties. In effect, this shifts a portion of schools’ maintenance and operation costs to the state, which in turn enables school districts to lower their property tax rate, effectively lowering property taxes for all property owners.

In addition, the homestead exemption for the primary residence of homeowners increases from $40,000 for school property taxes to $100,000. This provision accounts for $5.3 billion of the $18 billion tax relief package. In addition, non-homestead property now has a cap of annual property tax increases (appraisal values) of 20% for the next three years. This cap applies to non-homestead properties (such as second homes, vacation properties, rental properties, commercial retail and other business properties) valued at $5,000,000 or less.

Prior to this new legislation, there was an annual cap of 10% for homestead property but no cap for non-homestead property. On average, this tax relief reduces property taxes more than 40% for the 5.7 million homeowners in Texas, as well as reducing property taxes for owners of other properties. The reduction is achieved through a combination of the increased homestead exemption and lower property tax rates. The relief will equate to approximately $1,300 in annual tax savings for the average homeowner or $2,500 over the next two years. The actual savings will vary by school district.

Additional tax savings of approximately $170 per year are also awarded to senior citizens and property owners with certain disabilities. The property tax relief is much welcomed by property owners who have consistently been burdened with some of the highest property taxes in the United States.

Franchise Tax Relief

Texas has imposed a form of business taxation for many years. Technically and statutorily, this tax is the Texas franchise tax, which has been imposed since 1907 but is more commonly known since 2008 as the Texas margin tax. This unique tax (since its significant modification in 2008) has been very generous towards small businesses doing business in Texas. The recent relief has made this tax even more favorable for small businesses doing business in the state.

Prior to the recent relief, businesses that had gross receipts for the year below certain amounts were exempt from the Texas margin tax. This gross receipts limit (more specifically known as the “no tax due threshold”) is adjusted annually for inflation. The no tax due threshold for the 2023 year (and 2022) before the passage of the most recent tax relief package was $1,230,000 (increased from $1,180,000 for the year of 2021 and 2020). Thus, if the taxable margin (income) was less than $1,230,000 for the 2023 year (and 2022), no Texas margin tax was due.

As a result, numerous small businesses (and not so small businesses) were not subject to the Texas margin tax. Businesses with a Texas franchise tax due of less than $1,000 were, before the enactment of the new legislation, exempt from paying the franchise tax and continue to be exempt.

The most recent tax relief package has greatly extended the exemption of the Texas margin tax for numerous small businesses (and not so small businesses), which will now include many more businesses. After the voter approval of the new tax relief package in the November 7, 2023 general election (Senate Bill 2 for property tax relief), the annual no tax threshold increased from $1,230,000 to $2,470,000, more than doubling the previous annual amount. (Senate Bill 3 provided for this amendment for franchise tax relief.) As a result, approximately 67,000 additional businesses doing business in the state are exempt from the Texas margin tax. This increase in the no tax threshold took effect on January 1, 2024.

Summary

This article highlights the enormous tax relief that the governor and Texas Legislature handed to taxpayers. Major tax relief is being afforded to property owners, both homeowners and business property owners. The property tax relief is the signature piece of this legislation in which a very large portion of school maintenance and operation costs will be paid from sales tax revenues, which in turn require school districts to significantly reduce their property tax rates. This significant reduction provides immediate tax savings to property owners.

In addition to a lower school tax rate, homeowners will benefit by a significant increase in the homestead exemption from school property taxes. The homestead exemption more than doubled from the previous $40,000 to $100,000.

Non-homestead property (such as second homes, vacation properties, rental properties, commercial retail and other business properties) valued at $5,000,000 or less receives a first of its kind cap of annual appraisal value increases for a temporary three-year period. This new and innovative relief for non-homestead property is limited to a 20% per year increase in the appraised value of the property. Prior to this provision, non-homestead property owners had no protection from exorbitant annual increases in appraised value of their properties.

Modest property tax relief is also provided to senior citizens and property owners with certain disabilities.

Finally, the already generous Texas franchise tax (Texas margin tax) protection for small businesses has become even more favorable. For the 2023 year (and 2022), businesses with gross receipts of $1,230,000 were exempt from paying the franchise tax. Beginning January 1, 2024, the gross receipts amount is raised to $2,470,000, more than doubling the previous $1,230,000. This large increase in the gross receipts floor removes approximately 67,000 small businesses from the franchise tax payroll. Before the enactment of the new legislation, businesses with a Texas franchise tax due of less than $1,000 were exempt from paying the franchise tax and continue to be exempt.

Texas is noted for doing big things in very big ways. This $18 billion tax relief package, the largest in state history, very vividly continues this notion. A record budget surplus of $33 billion enabled this large tax relief package, with more than half of the budget surplus being returned to taxpayers through the large tax savings in property taxes and franchise taxes that immediately materialized. With property taxes in Texas traditionally being among the highest in the United States, this relief is not only very timely, but addresses a true need of the property owners.

Related CPE:

Summit - August (18) 19-20 - San Antonio and Webcast

Free for Members - Texas Taxes: 2024 Quarterly Update Q2 - July 25 - Webcast

CPE by the Sea - June 11-13, 2024 League City

About the Author: Marvin J. Williams, MBA, JD, CPA, CMA, CFM, CGMA, is a Professor of Accounting and Taxation at the University of Houston-Downtown. Contact him at williamsm@uhd.edu.

Bibliography

1. Texas Senate Bill 2 (2023 88th Legislature 2nd special session)

2. Texas Senate Bill 3 (2023 88th Legislature 2nd special session)

3. House Joint Resolution 2 (2023 88th Legislature 2nd special session)

4. The Texas Tribune (July 25, 2023)

5. Houston Chronicle – Austin Bureau (July 11, 2023)