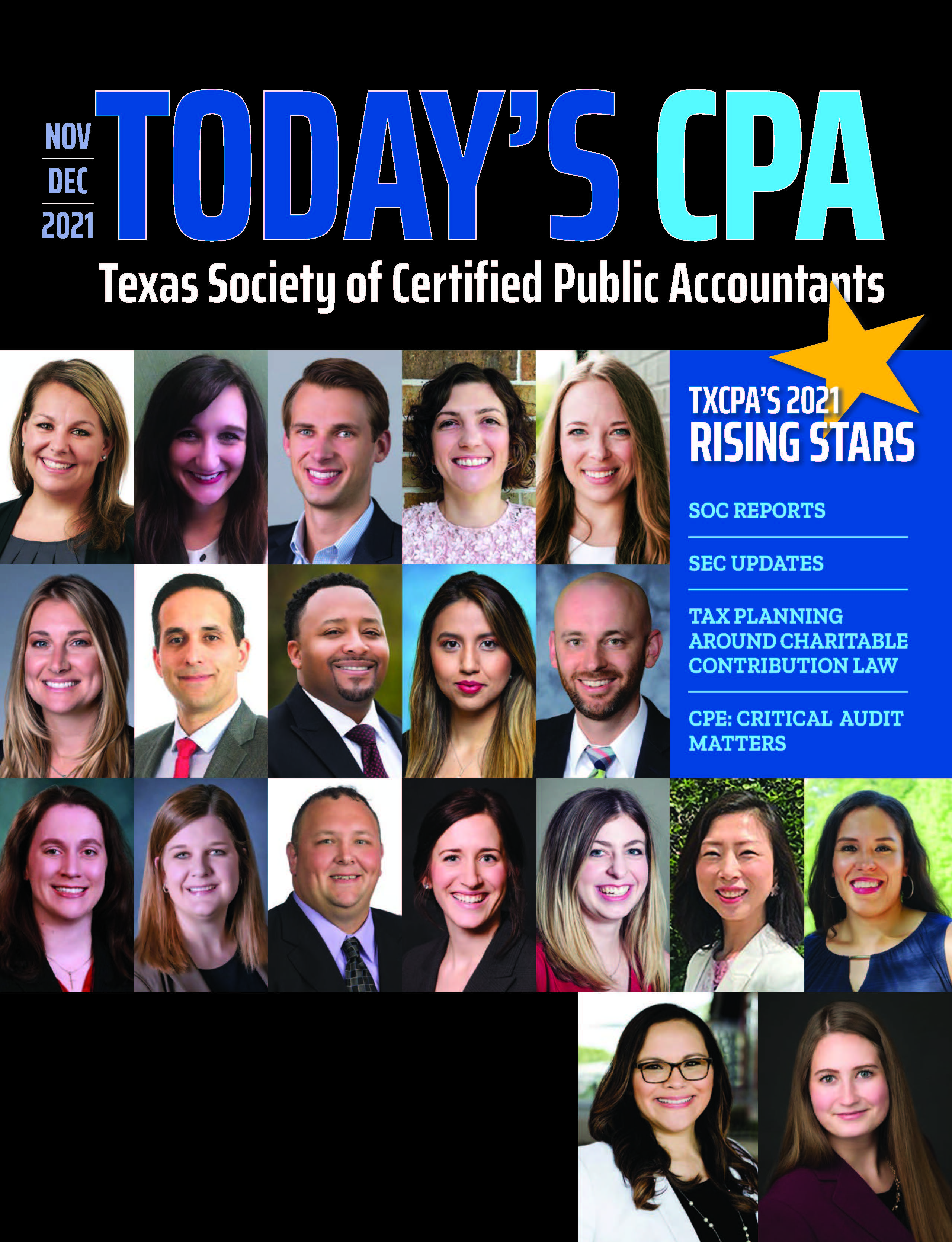

2021 Rising Stars

By DeLynn Deakins, Today’s CPA Managing Editor

Through the Rising Stars Program, TXCPA recognizes CPA members 40 years old and younger who have demonstrated significant leadership qualities and active involvement in TXCPA, the accounting profession and/or their communities.

A TXCPA selection committee named the following 19 up and comers based on their contributions to the accounting profession and their communities. We now introduce you to the members, in alphabetical order, who are the Rising Stars honorees for 2021.

Elizabeth Bailey, CPA | Austin Chapter | Tax Manager | Pope Shamsie & Dooley LLP

Elizabeth Bailey provides both compliance and consulting services to clients, and prepares tax provisions and returns for both public and private companies.

In her professional career, she has shown continued success, a desire to assume new responsibilities and a strong commitment to the CPA profession.

She has been involved in TXCPA Austin’s Leaders Emerging in the Accounting Profession (LEAP), community service activities and served on the chapter’s Executive Board.

Christine Bessert, CPA | Fort Worth Chapter | Manager | BKD LLP

Christine Bessert provides tax compliance for an array of clients in multiple industries while also helping to develop newer associates.

She has become one of only a few energy and natural resource (ENR) tax compliance and consulting experts throughout her firm of nearly 3,000 people. She worked directly with the firm’s tax software developers to enhance depletion capabilities within their returns.

She is a committed volunteer for TXCPA, her chapter and in the community.

Jonathan Cameron, CPA, CGMA | Fort Worth Chapter | Director of Finance/CFO | Southwest Christian School Inc.

Jonathan Cameron leads the team responsible for accounting, payables, tuition billing and financial aid at Southwest Christian School. He also presents financial reports to the board of trustees.

He and the business office staff have replaced cumbersome, manual processes with automated processes, streamlined quarterly financial reports, increased cash reserves and formed an investment committee to provide advice on preparing for the future.

Under his guidance, TXCPA Fort Worth’s largest annual event - Members CPE Day - was transformed from a multi-room event with multiple speakers to a successful online program. He also serves on the Accounting Program Advisory Council for the Tarrant County College Connect Campus.

Sarah DeVore, CPA, CFE | Fort Worth Chapter | Project Accountant | D.R. Horton/DHI Communities

At D.R. Horton/DHI Communities, Sarah DeVore records journal entries, reviews expenses and provides coding. She also reviews job costs for budget variances, prepares monthly balance sheet reconciliations and reviews employee expense reimbursements.

While serving in the U.S. Army, she was selected to be a member of the Fort Huachuca installation Honor Guard team. The Honor Guard is responsible for the ceremony of burying a fallen soldier. Serving as a member of this team was a privilege and an honor.

As a committed volunteer, she helped to expand TXCPA Fort Worth’s student outreach efforts and reached out to firm leaders to identify soft skills they would like students to have. With this information, she then organized a student outreach event for more than 265 students.

Stephanie Ferguson, CPA | Austin Chapter | Managing Director | BKD LLP

Stephanie Ferguson oversees a full client load and directs staff to manage BKD LLP’s Austin office, with emphasis in business/entity tax return preparation and planning.

She built a specialty cryptocurrency practice in her firm and works with clients on IRS audits and issues related to blockchain technology. She sits on BKD’s cryptocurrency committee and handles the tax and accounting issues for the firm’s largest crypto clients.

She is considered to be an intentional leader who leads by example and cares about the wellbeing of the people who work with and for her.

Lindsey Fontenot, CPA | Southeast Texas Chapter | Associate II | Andersen

Lindsey Fontenot gained experience in the accounting profession by working her way up through the ranks to her current position at Andersen Tax LLC. She also has experience in customer service, organization and leadership.

She has served on the TXCPA Southeast Texas Board of Directors as secretary and as chair of the chapter’s Scholarship Fundraising Committee, and researched, developed, organized and implemented the chapter’s first-ever Virtual Walk and Run event. The event raised more than $1,200 for Lamar accounting student scholarships.

She also participated in the Leadership Beaumont class of 2020-2021, where her team’s project focused on raising awareness about the struggles local businesses face to open and keep their businesses running. The program created lasting positive impacts in the community.

Taylor Franta, CPA | Dallas Chapter | Audit Planning Manager | Howard LLP

Taylor Franta manages the performance and completion of attestation engagements, participates in the retooling of processes used internally for engagement completion, performs and assists with professional and technical staff development training, and assists in research and implementation of new technologies.

As a member of TXCPA Dallas, she has served as both member and chair of the Awards Committee, as a member of the Vision Committee and CPE Council, as well as a member of the chapter's Finance Committee.

She is a graduate of the University of North Texas and has returned to her alma mater to give input on curriculum and teaching practices, has been an active part of the UNT Junior Accounting Advisory Board, served as a guest lecturer, and has been involved in a formal mentorship program that helps guide student ambitions and career trajectory.

Lorena Hernandez, CPA | Rio Grande Valley Chapter | Cameron County Auditor | Cameron County, Texas

Lorena Hernandez is currently the Cameron County Auditor, appointed by the District Judges of Cameron County, Texas on Sept. 16, 2021. She oversees all financial aspects and audit oversight of the county and is responsible for the preparation of the county’s Annual Comprehensive Financial Report (ACFR). Earning her CPA license at the age of 24, her previous experience includes managing the finances of the Port of Brownsville as CFO, as well as audit and tax services in public accounting, and internal auditing.

She completed her Master of Accountancy from the University of Texas Rio Grande Valley, where she also adjuncts, having taught an undergraduate course on “Ethics for Accountants.” She is an active member of TXCPA, AICPA and GFOA.

She volunteers her time and accounting expertise to assist local non-profits and has been invited to her alma mater as a guest speaker to share her experience as a first-generation student, encouraging accounting students to obtain their CPA license.

Amanda Klein, CPA | Austin Chapter | Tax Manager | Cary, Trlica & Wood, P.C.

Mandy Klein’s practice focuses on federal tax compliance, including matters related to individual, corporate, partnership, trust, and estate and gift taxation. She has worked extensively with high-net worth family groups, including closely held businesses, family partnerships and family trusts.

Her industry experience includes real estate, construction, manufacturing, technology and professional services. She is regarded as a detail-oriented CPA who is committed to helping clients achieve their long-term goals by providing high-quality client service that incorporates their complete financial situation.

She completed the TXCPA Austin Pathway to Leadership Program and has been active in LEAP and community service activities. She also served on TXCPA Austin’s Executive Board as the manager of education and leadership.

Christina Koucouthakis, CPA, CGMA | San Antonio Chapter | Senior Director, Financial Reporting | USAA Real Estate

Christina Koucouthakis primarily works on executive management and investor reporting at a real estate investment management company with over $26 billion in assets under management. She performs investment management analysis, reporting and forecasting, and works on collaborative projects focused on improving reporting and processes.

She is a former elementary school teacher and NCAA Division II collegiate volleyball player, both of which lit her passion to become involved in student-focused volunteering opportunities.

She has served on TXCPA San Antonio’s Board of Directors, was selected as Young CPA of the Year for 2020, and served double duty as co-chair of both the Jr. Duel in Ol’ San Antonio and Education and Accounting Careers committees. She exhibits a drive to enrich students’ lives through financial literacy and bringing awareness of diverse career paths available to CPAs.

Thomas Neuhoff, CPA, CFP®, PFS | East Texas Chapter | CFO | Herd Family Office

Thomas Neuhoff manages planning opportunities and compliance needs in his role as CFO of a single-family office. He coordinates CPAs, attorneys and investment advisors to maximize the after-tax impact for families and the community.

During the chaotic time of the pandemic, he jumped in and researched day-by-day legislative changes and related impacts. He shared information within his firm, on social media with their clients, and also within the east Texas community of business professionals.

He currently serves on the Leadership Tyler Board and is involved with Mentoring Alliance as an advocate and mentor. Previously, he founded Give Victory Foundation, a 501(c)(3) organization that existed to help homeless men and women get back on their feet, literally and figuratively. In two years, they were able to put over 500 new pairs of shoes and socks on the feet of the homeless and raise tens of thousands of dollars to meet pressing needs.

Meredith McKeehan, CPA | Permian Basin Chapter | Audit Senior Manager | Weaver

As Audit Senior Manager, Meredith McKeehan oversees and manages audit, review and compilation engagements in the oilfield service, manufacturing, construction, not-for-profit, and government industries.

She also builds content for trainings and schedules all of the client work.

She is on the Board of TXCPA Permian Basin, where she’s highly involved in chapter activities and recruiting new members. She’s also very involved at her church and sits on the board of several nonprofits, including Meals on Wheels, which provides meals to the homeless and low-income families.

Ruth Olivares, CPA, CFE | San Antonio Chapter | Manager | ATKG, LLP

Ruth Olivares performs and reviews financial statement reviews and compilations for individuals and various industries, and investigates and analyzes data used in litigation in the areas of business valuation, marital estates and forensic accounting.

She is a very active member in TXCPA San Antonio, where she has served as vice president and on the Board of Directors, co-chaired the Young Accounting Professionals (YAP) Committee, chaired the Member Involvement Committee, supported other outreach projects, and more.

She is also a board member of the Alamo Kiwanis Club and Select Federal Credit Union.

Omar Rodriguez, CPA | El Paso Chapter | Manager, ESG and Sustainability Services | PwC

Omar Rodriguez is a CPA and FSA credential holder with over nine years of experience that includes providing audit, assurance and accounting advisory services. His recent experience includes assisting clients with their evaluation and implementation of new accounting pronouncements, complex transaction accounting, financial and non-financial reporting, and other advisory services.

In his community, he serves on the University of Texas at El Paso Accounting Information Systems Advisory Council, the El Paso Opera Board of Trustees and the TXCPA El Paso Board of Directors. His prior service included serving within the Young CPAs (YCPA) of El Paso and for Project Bravo.

He is an EMBA Candidate, and a member of TXCPA, AICPA and the Association of Latino Professionals for America (ALPFA).

Hyun “Crystal” Shin, CPA | Dallas Chapter | Director of Business Development | EisnerAmper

In her position at EisnerAmper, Crystal Shin takes ownership of the sales process by identifying and securing new opportunities for the firm. She also develops close relationships with strategic partners and C-level executives in various industries.

She has been an active member of the TXCPA Dallas B&I Committee and was recognized as a Committee Member of the Year. As a committee member, she assisted on project management and marketing for “Behind the Scenes” events, helped produce an encore effort on the blockchain topic, and assisted in an event that was co-hosted with the Dallas Bar Association.

She is passionate about giving back to the community and has served the children’s ministry within her church, has been a speaker for various speaking engagements, and is a board member of 4word: Dallas, a community of professional Christian women.

Peter Simon, CPA | Southeast Texas Chapter | Manager | Edgar, Kiker & Cross, PC

Peter Simon’s responsibilities include tax compliance, financial reporting, write-up and bookkeeping, payroll compliance, and staff training.

He ran track for Louisiana State University and was a part of two national title teams. He is enrolled in the class of 2021-2022 Leadership Southeast Texas.

He is currently serving as a member of the Board of Directors for TXCPA Southeast Texas and the Beaumont Public Schools Foundation. He is also serving as Membership Committee chair for TXCPA Southeast Texas, playing a key role in personal outreach, and is a member of TXCPA’s Diversity and Inclusion Committee.

Catherine Speer, CPA | Permian Basin Chapter | Shareholder and Assurance Partner | Whitley Penn

Catherine Speer advises clients on audit and accounting in the energy, manufacturing and construction industries, as well as governmental and nonprofit organizations.

She is currently serving as TXCPA Permian Basin’s 2021-2022 vice president and has been an active member of the Board of Directors.

She enjoys giving back to her profession and community through service on the University of Texas Permian Basin Internal Audit Committee and as president on the board for the Samaritan Counseling Center.

Brittin Stange, CPA | Corpus Christi Chapter | Tax Manager | Carr, Riggs & Ingram

Brittin Stange supervises, trains and mentors tax seniors, staff, interns and bookkeepers. He also prepares and reviews tax returns for individuals and businesses across numerous industries, provides consulting services and tax planning, and builds, develops and maintains client relationships.

He has served on the TXCPA Corpus Christi Board of Directors and jumped right in, participating in student and community activities as needed. He has also persuaded some of his coworkers to participate in chapter activities.

With a desire to help those in need, he assisted in recovery efforts after Hurricane Harvey left a path of destruction. He continues to assist with providing meals for those in need and believes that helping people is at the core of the accounting profession.

Katelyn Woods, CPA | Fort Worth Chapter | Audit Senior Manager | Whitley Penn

In her position at Whitley Penn, Katelyn Woods performs and manages audits of private companies, with a focus on the energy industry.

She was a recipient of the Elijah Watt Sells Award. To receive this award, a cumulative score average above 95.5 must be achieved across all four sections of the CPA Exam. In addition, the Texas State Board of Public Accountancy asked her to speak at her induction ceremony, as she received one of the top scores in Texas on the CPA Exam during that time period.

As a member of TXCPA Fort Worth’s Board of Directors, she has brought great perspective to leadership decisions. She is a firm representative for Santaccountants and coordinates one of the largest collection centers for TXCPA Fort Worth. She also serves on the Junior Accounting Advisory Board for the University of North Texas. Additionally, through TXCPA, she became involved with Academy4, a mentoring program for 4th graders in economically disadvantaged schools around Fort Worth.

Rising Star Nominations Now Open!

If you have a friend or colleague who has shown innovative leadership qualities within the accounting profession, their local community or TXCPA, we want to hear from you! Anyone can nominate a rising star, but the nominees must be TXCPA members. Submit your nominations by December 31, 2021.