CPE: Joint Ventures and Equity Method Accounting

By Josef Rashty

~~ ~~ ~~ ~~ ~~ ~~ ~~ ~~ ~~ ~~ ~~ ~~ ~~ ~~ ~~ ~~ ~~ ~~ ~~ ~~

CPE Self Study Article & Quiz Register to gain access to the self-study quiz and earn one hour of continuing professional education credit by passing the quiz.

~~ ~~ ~~ ~~ ~~ ~~ ~~ ~~ ~~ ~~ ~~ ~~ ~~ ~~ ~~ ~~ ~~ ~~ ~~ ~~

CPE Hours: 1

Curriculum: Accounting and Auditing; Management

Level: Basic

Designed For: CPAs in business and industry and public practice

Objectives: To discuss the fundamentals of the equity method accounting for joint venture investments and highlight some of the issues related to this complex area of accounting

Key Topics: Equity method of accounting; objectives of ASU 2023-05; significant influence; joint control; intra-entity transactions; goodwill; joint venture exclusions

Prerequisites: None

Advanced Preparation: None

~~ ~~ ~~ ~~ ~~ ~~ ~~ ~~ ~~ ~~ ~~ ~~ ~~ ~~ ~~ ~~ ~~ ~~ ~~ ~~

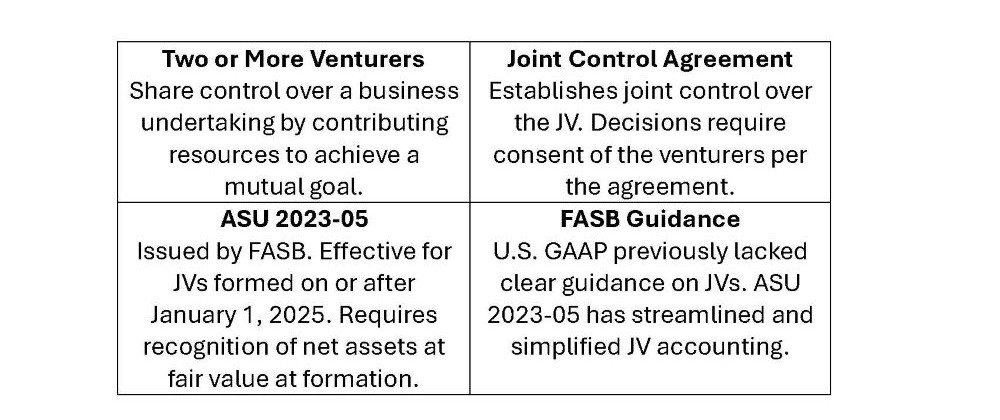

Joint ventures (JVs) involve two or more parties (venturers) who share control over a specific business undertaking by contributing resources to achieve a mutual goal. The life JV is limited to that of the venturers’ undertaking, which may be of short or long-term duration, depending on the circumstances.

The distinctive feature of a JV is an agreement (usually in writing) establishing joint control governing the relationship between the venturers. Decisions in all areas essential to the accomplishment of the JV’s goals require the consent of the venturers, as provided by the agreement; none of the individual venturers can unilaterally control the venture. This feature of joint control distinguishes investments in JVs from investments in other enterprises where control of decisions is related to the proportion of voting interest held.

In August 2023, the Financial Accounting Standards Board (FASB) released ASU 2023-05, Business Combinations – Joint Venture Formation: Recognition and Initial Measurement, codified under Subtopic 805-60. This ASU addresses the accounting by a JV for the initial contribution of nonmonetary and monetary assets to the venture. FASB requires that JVs formed on or after January 1, 2025, adopt this ASU, with early adoption permitted.

This article expounds on applying the equity method to the formation of JVs and accounting for subsequent years from the perspective of venturers.

Definition

ASC 323, Investments-Equity Method and Joint Ventures, defines a corporate joint venture as a corporate-owned entity that a small group of joint venturers owns and operates for a specific business purpose and their mutual benefits. A corporate JV usually provides an arrangement under which each of the joint venturers may participate, directly or indirectly, in the overall management of the JV. Joint venturers thus have an interest or relationship other than as passive investors.

There are no legal or accounting restrictions on the size of JVs. The Wall Street Journal (Jan. 22, 2025) reported that Italy’s Generali and the owner of France’s Natixis will combine their asset management operations and create a European giant overseeing €1.9 trillion, or $1.979 trillion, in assets. The venturers will own the JV 50-50 (B11).

Objectives of ASU 2023-05

FASB issued this ASU because there was no guidance on recognizing and measuring the contribution of nonmonetary and monetary assets in a JV’s stand-alone financial statements. While the ASU does not change the definition of a joint venture, it establishes a new basis of accounting upon the venture’s formation.

This ASU has the following dual objectives:

- To standardize the accounting practices for how JVs recognize contributions from venturers at the time of formation.

- To reduce diversity in practice about how a JV or corporate JV accounts for the contributions it receives from its venturers upon formation.

The ASU requires JVs, upon formation, to (1) recognize and measure the initial contributions of monetary and non-monetary assets by the venturers at fair value and (2) measure its net assets (including goodwill) at fair value by using the fair value of the JV as a whole. Therefore, upon adoption of ASU 2023-05, a JV will measure its total net assets upon formation as the fair value of 100 percent of the JV’s equity immediately after formation.

Acquisitions

Many equity investments do not require the complete acquisition of investees and their consolidations. Depending on circumstances, companies may account for an equity investment through consolidation, equity or fair value. Generally, an investor accounts for an investment as a consolidated subsidiary when it can exercise control over the subsidiary; however, if the acquirer maintains only significant influence over the investee, it uses the equity method of accounting.

If an investor exercises neither control nor significant influence over the acquiree, the proper method of accounting for the investor is the fair value method. Investors in partnerships, unincorporated JVs and limited liability companies (LLCs) generally account for their investments using the “equity method of accounting” if the investor can influence the investee significantly.

Equity Method of Accounting

Venturers generally account for an investment in a JV under the equity method of accounting (ASC 323, Investments – Equity Method and Joint Ventures). Suppose a JV is considered significant to a venturer registrant. In that case, the venturer registrant may need to provide the JV’s separate financial statements or summarized financial information in the financial statement footnotes. The information a registrant must present depends on the significance level, which is determined based on the results of various tests outlined in SEC Regulation S-X.

Investors may account for an equity investment as consolidation, equity method or fair value method. Generally, an investor accounts for equity investments using consolidation when it has control, the equity method when it has significant influence and the fair value method when it has neither control nor significant influence.

When a JV's equity turns negative, the venturer's balance sheet reflects zero equity for that investment. However, depending on the JV's corporate structure, the venturers may still have a financial obligation for the JV's liabilities.

Significant Influence

An investor is considered to have significant influence – without control – if it owns 20 percent to 50 percent of an investee’s voting stock and does not control the subsidiary. FASB bases this on ownership of voting securities and requires the equity method when significant influence exists. In some cases, influence may be present with as little as 3 percent ownership. Indicators of significant influence are outlined in ASC 323-10-15-6 to -11:

- Board of directors’ representation and participation in policymaking processes;

- Material intra-entity transactions and technological dependency;

- Interchange of managerial personnel and extent of ownership.

Joint Control

The concept of joint control is the most distinctive characteristic of a JV. Accounting Standards Executive Committee (AcSEC), in its 1979 Issue Paper (not an authoritative guidance), defines a joint venture as arrangements whereby two or more parties (the venturers) jointly control a business undertaking [51(b)]. This definition implies that all venturers should consent to any business decisions. This feature of joint control distinguishes JVs from investments in other types of entities where control of decisions is related to the proportion of voting interest held by investors.

Even though the AcSEC 1979 Issue Paper is not an authoritative guidance, accounting practice has widely adopted and applied it.

Table 1 highlights key aspects of joint ventures, including how two or more venturers share control, the role of joint control agreements and recent accounting changes under ASU 2023-05.

Table 1: Overview of Joint Venture Control and ASU 2023-05 Guidance

Other Assets and Liabilities

JVs capitalize as indefinite-lived intangible assets all in-process intangible research and development assets (IPR&D) that venturers have contributed to a JV at its formation, consistent with the accounting model for business combinations (ASC 805).

JVs may contribute one or more businesses to the JV that have employees with share-based payment awards. In these situations, the JV determines the portion of the compensation expense it should attribute to the employees’ pre-formation and post-formation services based on ASC 718 (Compensation-Stock Compensation) as equity or liability. JVs account for pre-formation vested awards as additional paid-in capital (APIC) or other similar equity account.

JVs account for contingent considerations as liabilities (or assets) at their formation.

Intra-Entity Transactions

ASC 323 requires investors to incorporate specific adjustments to the carrying amount of their investments to determine the net income associated with such investments. These adjustments include eliminating intra-entity profits and losses in some cases until realized by the investor or investee as if the investee were consolidated (ASC 323-10-35-7).

Investors may sell (downstream transactions) or purchase (upstream transactions) assets to or from investees. Such assets are not the output of an entity’s ordinary activities. ASC 323 requires that investors and investees engage in these activities as arm’s length transactions.

Transactions between an investor and an investee could be subject to ASC 606 – that is, if the item sold is an output of an entity’s ordinary activities, the investor will eliminate its proportionate share of the profit from intra-entity transactions until that profit is realized in transactions with third parties (ASC 323-10-35-7).

Basis Difference

Under the equity method, investments are initially recorded at cost (ASC 323-10-30-2; ASC 805-50-30). Any “basis difference” between the investment cost and the investee’s net assets is allocated to specific assets, goodwill or intangibles, as if the investee were a consolidated subsidiary (ASC 323-10-35-13). Despite this, the investment appears as a single-line item on the investor’s balance sheet – dubbed a “one-line consolidation.”

Subsequent Measurements

After initial measurement, the carrying amount of an equity method investment adjusts for the investor’s share of earnings or losses (ASC 323-10-35-4). These amounts are reported on a single line in the income statement and investment account. The equity method is discontinued if the investment balance falls to zero due to investee losses (ASC 323-10-35-20).

The equity method mandates companies to record their initial investments at cost, after which they adjust their investments for the actual performance of the JV. The following calculation illustrates how the equity method operates:

+ Initial investment recorded at cost

+/- Investor’s share of joint venture profit or loss

- Distributions received from the joint venture

= Ending investment in joint venture

Goodwill

ASC 350, Intangibles–Goodwill and Other, defines goodwill as “an asset representing the future economic benefits arising from other assets acquired in a business combination that are not individually identified and separately recognized.” In other words, goodwill represents the premium an acquirer is willing to pay above the fair value of the acquired entity, reflecting the anticipated future economic benefits.

The following is an excerpt from Microsoft's Form 10-Q for the quarterly period ended March 31, 2023:

"Goodwill was assigned to our Intelligent Cloud segment and was primarily attributed to increased synergies that are expected to be achieved from the integration of Nuance. None of the Goodwill is expected to be deductible for income tax purposes."

This excerpt refers to "increased synergies." Microsoft claims that it plans to achieve this synergy through its business combination. If it fails to do so, the recorded goodwill may be subject to impairment.

JVs do not meet the definition of business combinations under ASC 805; however, they may recognize goodwill. JVs recognize goodwill upon formation as the excess of (a) over (b):

a. The formation-date fair value of the JV, as a whole, equals the fair value of 100 percent of the JV's equity (net assets) immediately following formation, including any non-controlling interest (NCI) in the net assets recognized by the JV.

b. The net amount of the formation-date identifiable assets and liabilities recognized by the JV (ASC 805-20). Assets and liabilities, not part of the formation, are excluded from the goodwill calculation.

The initial measurement of a JV is similar to pushdown accounting, where asset and liability bases are adjusted to fair value. Unlike business combinations, JVs treat negative goodwill as an equity adjustment, not a bargain purchase gain. The JV adopts the acquirer’s stepped-up basis in its financial statements.

Companies that do not meet the definition of public business entities (PBEs) can potentially amortize their goodwill on a straight-line basis over 10 years or less (ASU ((2013-12)), Definition of a Public Business Entity. This guidance eliminates goodwill's annual impairment test. It requires the test only when an event or circumstance indicates that the entity's fair value (or reporting unit) may be less than the carrying value. JVs usually adopt venturers' policies for goodwill impairment testing and amortization.

Goodwill and Bargain Purchase Price. The amount an investor pays to acquire an equity method investment differs from its proportionate share of the carrying value of the investee’s underlying assets and liabilities (ASC 323-10-35-34), which is the “basis difference.” If the acquirer cannot attribute such a basis difference to specific assets and liabilities that it has acquired, it reflects it as “equity method goodwill.” Under certain circumstances, the investor’s share of an investee’s net assets is higher than the consideration paid. If the investor cannot attribute the negative basis difference to specific assets or liabilities, it recognizes it as “bargain purchase price” or “negative goodwill.”

ASC 323-10-35-13 implicitly requires that companies treat any negative goodwill in equity method investments consistent with the consolidation accounting model. Thus, companies recognize any excess fair value of the identifiable net assets over the cost of the equity method investment in earnings on the investment date, consistent with FASB’s business combination guidance (ASC 805-30-25-2).

Amortization of goodwill may be deductible in some tax jurisdictions. Companies recognize tax benefits arising from excess tax-deductible goodwill, which results in the recognition of DTA similar to any other temporary differences (ASC 805-740-25-9). However, the recognition of DTL for financial reporting goodwill over tax-deductible goodwill is prohibited (ASC 740-10-25-3(d)).

JV Exclusions

Asset Acquisitions. Joint venture investments differ from “asset acquisitions.” A business combination is a transaction or event by which an acquirer obtains control of a business.

Suppose acquiring an asset or asset group (including liabilities assumed) does not constitute a business. In that case, the transaction is no longer a business combination and the acquirer accounts for it as an “asset acquisition.” An asset acquisition transaction uses a cost accumulation model, whereas a business combination within the scope of ASC 805, Business Combinations, uses a fair value model.

Collaborations. JV investments are not collaborative arrangements. Collaborative arrangements aim to provide partners with a share of profits and losses in joint operating activities. In collaborative arrangements, partners usually share responsibilities, but one partner may be responsible for specific activities while others share the remaining responsibilities.

Counterparties in a collaborative arrangement often conduct their activities without creating a separate legal entity. As a result, collaborative arrangements usually provide a certain level of flexibility and less structure in their operations. Collaborative arrangements are typically within the scope of ASC 808, Collaborative Arrangements.

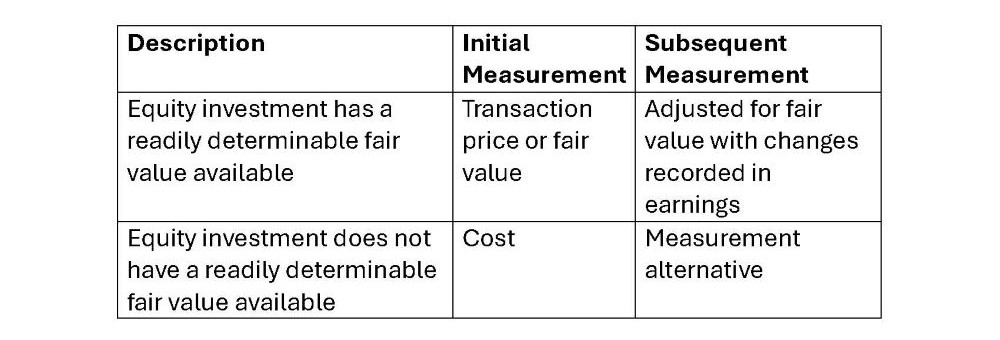

Fair Value Method Accounting

Companies use the fair value method for their equity investments when ownership is less than 20 percent of the investee’s outstanding shares and they do not have control or significant influence. These companies can record changes in the value of their investments in earnings. Table 2 reflects a summary of fair value accounting for equity investments.

Table 2. Summary of Fair Value Accounting for Equity Investments

Clarifying Joint Venture and Equity Method Accounting

Previously, U.S. GAAP lacked clear guidance on how JVs should recognize and measure contributed assets and liabilities at formation, leading to inconsistent practices. To address this, FASB issued ASU 2023-05, requiring JVs to apply a new basis of accounting – similar to pushdown accounting – and recognize net assets at fair value as of the formation date. Guidance for JV venturers remains unchanged.

This ASU has effectively streamlined and simplified the JV accounting process, significantly improving U.S. GAAP.

This article discussed the fundamentals of the equity method accounting for JV investments. A comprehensive discussion of equity method accounting is beyond the scope of this article. The objective was to highlight at least some rudimentary issues related to this complex area of accounting. The article wittingly avoided excessive details on some technical problems. Readers may want to refer to the FASB and other accounting literature for a more comprehensive discussion.

Click here to see three example illustrations.

Navigating the Essentials: Key Concepts and Insights Definition of Joint Ventures (JVs):

New Accounting Standard: ASU 2023-05:

Equity Method for Significant Influence:

Accounting for Basis Differences and Goodwill

Elimination of Intra-Entity Transactions

JV Exclusions

|

About the Author: Josef Rashty, CPA, Ph.D. (Candidate), is a TXCPA member and provides consulting services in Silicon Valley, California. He is also a faculty and adjunct professor of accounting. Readers may reach him at j_rashty@yahoo.com for comments and suggestions.

Thanks to the Sponsors of Today's CPA Magazine

This content was made possible by the sponsors of this issue of Today's CPA Magazine: