The Statement of GreenHouse Gas Emissions

The Rapidly Evolving Landscape of Sustainability and Climate Disclosure

By Stephen Franciosa, CPA

In the May/June 2023 issue of Today’s CPA, I questioned whether the GreenHouseGas Protocol’s Scope 3 emissions reporting was a step too early or too far. As of now, I’m still not convinced that Scope 3 reporting will be universally adopted at all, at least not in the foreseeable future. However, standardization and regulation of sustainability and climate disclosure (of which greenhouse gas emissions would be a subset) are rapidly evolving1.

Additionally, ongoing developments by standard-setters are keeping the landscape moving forward. In a global survey of more than 200 sustainability leaders, conducted in December 2024 and January 2025, nearly 70% of respondents said they developed an initial baseline for Scope 3 emissions and 54% have been collecting primary data to track progress2.

Investors currently need to sort through a cornucopia of sustainability information in standalone reports, investor questionnaires, shareholder resolutions, and Securities and Exchange Commission (SEC) filings. Yet each of these reports has limitations3. As time goes by and methods evolve that more efficiently garner and capture GHG emissions data, there is every reason to speculate that Scope 3 reporting will happen and could be presented on a single financial statement.

The Greenhouse Gas Protocol, launched in 1998, provides the world’s most widely used set of standards and guidance for measuring and reporting greenhouse gas emissions. It has developed guidance to identify, calculate and track emissions. In addition to developing standards, the GHG Protocol promotes its adoption to encourage a low emissions economy worldwide4. In addition to public and private resources, it remains the foundation for many climate action initiatives.

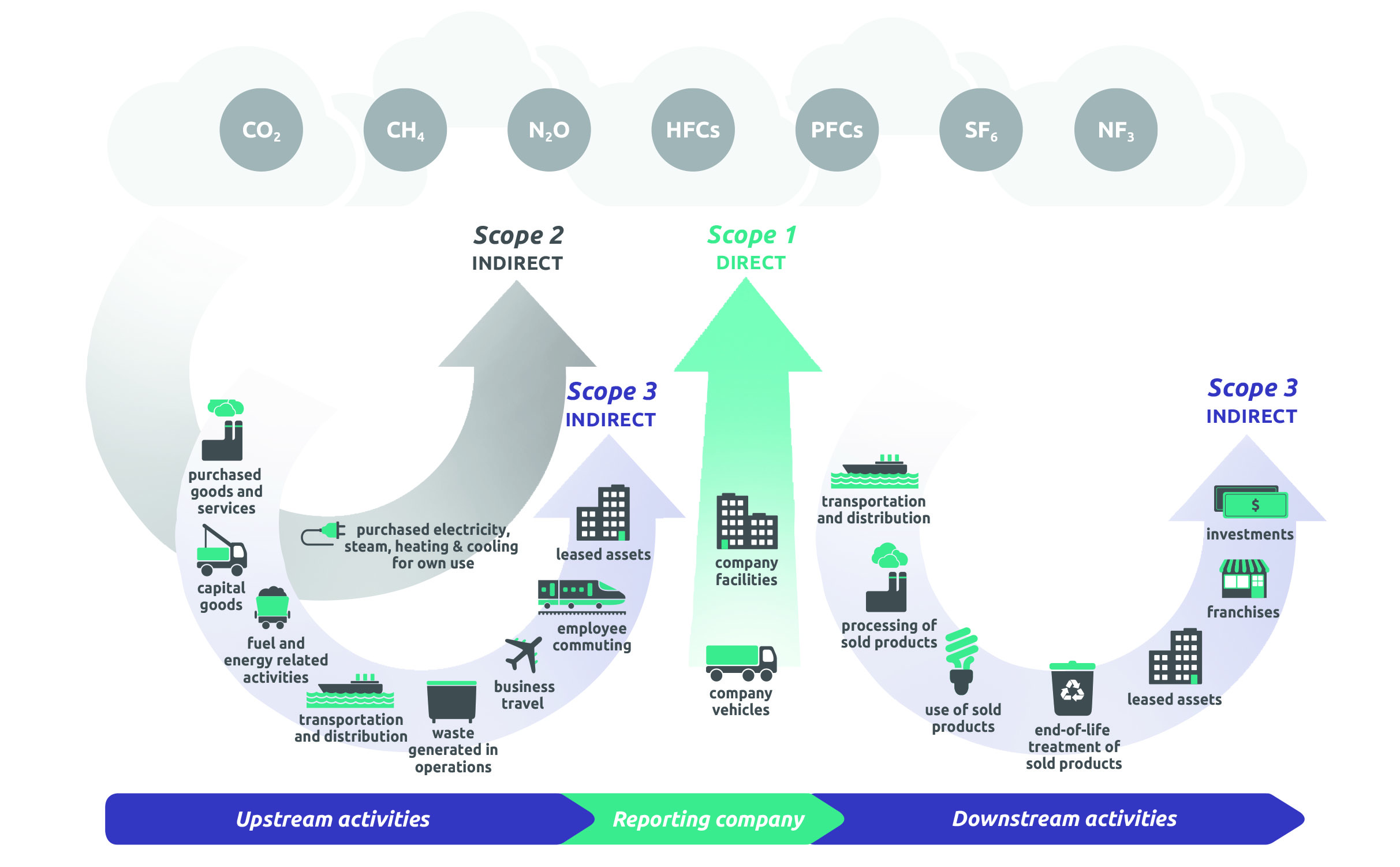

Measuring greenhouse gas emissions can be done by calculating activity data and emissions factors5. Scope 3 reporting would include the indirect emissions of a myriad of suppliers and customers (its value chain) or what is alternately termed upstream and downstream activities. Accordingly, a user-interactive financial statement would not only report on each activity but would likewise allow a user to drill down into the data and calculations from which emissions disclosures were derived. Creating a useful statement would need to relay information that is consistent from company to company in a sector/industry.

In a company’s value chain, a multitude of non-distinguishable suppliers and consumers contribute to an overwhelmingly complex set of activities. So not only does a sizeable challenge exist to precisely interpret and quantify material and energy transfers that occur at each activity throughout the company’s value chain, attesting to the veracity of the information will certainly prove formidable. Emissions metrics (i.e. tCO2e or tonnes of carbon dioxide or greenhouse gas equivalents) for each of the activities would be made available on a statement enabling stakeholders to search, extract and compare a company’s quantitative emissions disclosures.

For example, the IFRS Foundation has developed taxonomies to accommodate digital financial reporting of such information6. And while this and other taxonomies might facilitate quantitative presentation and disclosures, reporting entities would be ultimately responsible for the quality of such information.

A useful Statement of GHG Emissions would need to present information that is consistent from sector to sector, and industries within each sector. The GHG Protocol Corporate Value Chain Accounting and Reporting Standard – which established the Scope 3 standard – has delineated 15 upstream and downstream categories. In addition, it elaborates on each category description and summarizes calculation methods (i.e., taxonomies), including activity data and emission factors needed, data collection guidance, calculation formulae and examples. It also provides examples of primary and secondary data.

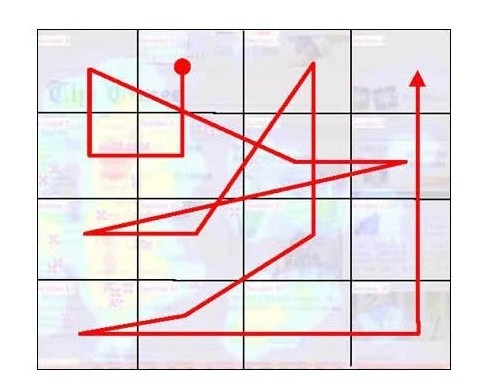

Researchers at the non-profit Poynter Institute’s Eyetrack III project7 have found that readers view various regions on a report in a certain order (see Figure 1), paying particular attention to specific regions called priority zones (see Figure 1A). Such priority zones can be leveraged to heighten or reduce attention on certain activities based upon “stakeholders” agreed-upon significance.

Figure 1: Sequence Readers View Various Regions

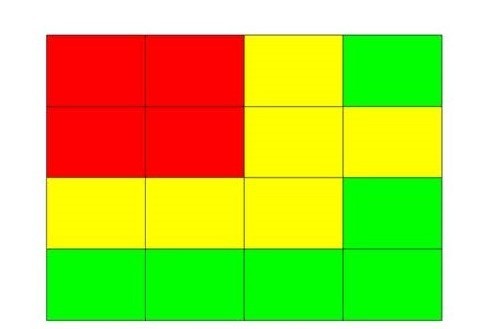

There are three areas of prominence (priority zones) with 1 being the highest and 3 being the lowest. My proposed financial statement presentation would be a 4 by 4 table of cells with each cell representing a specific upstream or downstream activity. Various studies have shown that readers should have a natural tendency to focus on particular regions of the statement.

Figure 1A: Priority Zones - Red = Priority 1, Yellow = Priority 2, Green = Priority 3

Figure 2 represents a graphic presentation of the aforementioned upstream and downstream activities8. Additionally, the list includes the activity emissions from energy – electricity, steam, heating and cooling – purchased for one’s own use, which is considered a Scope 2 activity in the GHG Protocol.

To facilitate presentation, I used the Sustainability Accounting Standards Board’s Industry Classification System (SICS). This comprehensive table (not shown, but available at sasb.ifrs.org/) delineates 11 business sectors that include 77 industries. SICS uses an (environmental) impact-focused methodology categorizing companies under a sustainability lens. For purposes of this article, I have chosen the Apparel, Accessories & Footwear industry in the Consumer Goods sector.

Figure 2: Graphic Presentation of Upstream and Downstream Activities

Figure 3 represents my proposed sample Statement of GreenHouse Gas Emissions of a generic Sample Apparel Company in the consumer goods industry sector. Ultimately, each activity category would disclose the GHG emissions derived through industry-accepted methodologies.

Figure 3: Sample Statement of GreenHouse Gas Emissions of a Generic Apparel Company

For presentation purposes, upstream and downstream activities have been color-coded. Red has been used for upstream activities and blue for downstream activities. Alternately, thematic color ramps could enhance the effectiveness of the table in representing variation, order, sequential values or different categories.

Again, the major question becomes what activity would be presented in each cell. For each of the activity cells, stakeholders (perhaps underwriters and investors) in an industry within a sector would need to determine and agree upon which of the upstream/downstream activities are most or least “consequential.” While this may not be a simple task, the effort would enable the reader to expeditiously home in on the activities deemed most critical.

Finally, at issue would be where this Statement of GreenHouse Gas Emissions would appear. In A Roadmap for Audit Practitioners – ESG Reporting and Attestation, the Center for Audit Quality states, “There is no one-size-fits-all approach to reporting ESG information.”9 It could appear as supplementary information to the company’s general purpose financial statements with a separate limited or reasonable assurance opinion. Or it could also be part of a company’s separate set of sustainability statements.

Regulators are now and would be expected to continue promulgating assorted presentations in securities filings, etc. Such presentations and other alternatives are currently the subject of debate and have yet to be conclusively mandated by authoritative bodies.

Related CPE: The Controllership Series - The Role of the Controller in ESG |

About the Author: Stephen Franciosa, CPA, is a sole practitioner on City Island in the Bronx, NY. His practice consists primarily of accounting and audit services to small non-profits. He is a member of AICPA, NYSSCPA, NCCPAP and the NYSSCPA Sustainability Accounting and Reporting Community. He has taught accounting and auditing courses at CUNY – Lehman College and Iona University.

Footnotes

1. Miani, G. et al. “#DeloitteESGNow - The Disclosure Heat Is On: The Move Toward International Standardization of Sustainability and Climate Reporting” Deloitte & Touche LLP, Heads Up Volume 29, Issue 6, 26 May, 2022.

2. “The State of Corporate Sustainability” Watershed, PowerPoint presentation slides 4 and 5, 2025.

3. D’Aquila, Jill M., Ph.D., CPA. “The Current State of Sustainability Reporting” CPA Journal, July, 2018.

4. Greenhouse Gas Protocol, Corporate Accounting and Reporting Standard & Policy and Accounting Standard, World Resources Institute. https://ghgprotocol.org/.

5. Walsh, Shelby. “How to Measure Your Carbon Emissions” Carbon Direct, 15 February, 2024. https://www.carbon-direct.com/insights/how-to-measure-your-carbon-emissions.

6. IFRS Foundation. Digital Financial Reporting – Facilitating digital comparability and analysis of financial reports. April, 2024. https://www.ifrs.org/digital-financial-reporting/.

7. Poynter Institute, the Estlow Center for Journalism and New Media and Eyetools, Inc., 2003. https://www.math.unipd.it/~massimo/corsi/tecweb2/Eyetrack-III.pdf.

8. Greenhouse Gas Protocol. Technical Guidance for Calculating Scope 3 Emissions (version 1.0) Supplement to the Corporate Value Chain (Scope 3) Accounting & Reporting Standard. P.6. https://ghgprotocol.org/sites/default/files/standards/Scope3_Calculation_Guidance_0.pdf.

9. A Roadmap for Audit Practitioners – ESG Reporting and Attestation, the Center for Audit Quality. P. 16. https://www.thecaq.org/wp-content/uploads/2021/02/caq-esg-reporting-and-attestation-roadmap-2021-Feb_v2.pdf.

Thanks to the Sponsors of Today's CPA Magazine

This content was made possible by the sponsors of this issue of Today's CPA Magazine: