From Pipeline to Mobility: TXCPA Champions Two Major Wins for the Accounting Profession

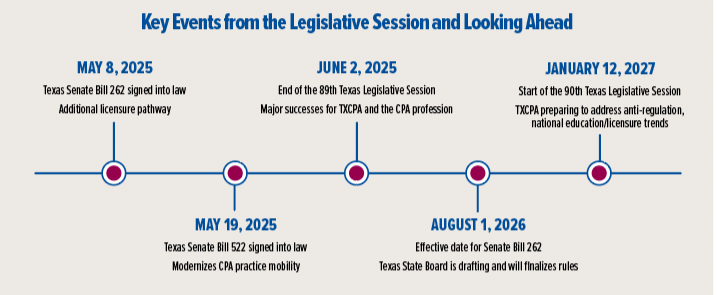

The 89th Texas Legislature brought major wins for TXCPA and the CPA profession. Senate Bill 262 creates an additional CPA licensure path – bachelor’s degree with accounting concentration, two years’ experience and passing the CPA Exam – effective August 1, 2026.

TXCPA also successfully advocated for a new individualized mobility law. Senate Bill 522 modernizes CPA practice mobility in Texas and ensures only well-qualified CPAs have practice privileges, setting a model for other states.

Both laws require new rules from the Texas State Board of Public Accountancy. TXCPA is working with stakeholders – students, candidates, accounting educators, higher education institutions, CPAs, and the State Board – to create clear, practical guidelines that support the additional licensure path and mobility provisions while honoring the legislature’s intent.

Looking ahead, TXCPA is monitoring national anti-regulation trends and working with other state societies to protect strong licensure and education standards, state boards, CPE requirements, and more that safeguard the public.

Want to get involved? Contact Kenneth Besserman at TXCPA.

About the Author: Kenneth Besserman, JD/LLM, is TXCPA's Director of Government Affairs and Special Counsel. Contact him at kbesserman@tx.cpa.

Thanks to the Sponsors of Today's CPA Magazine

This content was made possible by the sponsors of this issue of Today's CPA Magazine: