What Changes Are Coming to the 2024 CPA Exam?

By Jane N. Baldwin, Ph.D., CPA; R. Kathy Hurtt, Ph.D., CPA (Inactive); and David Hurtt, Ph.D., CMA

Evolution of the CPA Exam

CPAs remember their qualifying Exam quite differently depending on when they sat for it. The content and administration of the CPA Exam has evolved over time to keep pace with the growing complexity of business structures and technology.

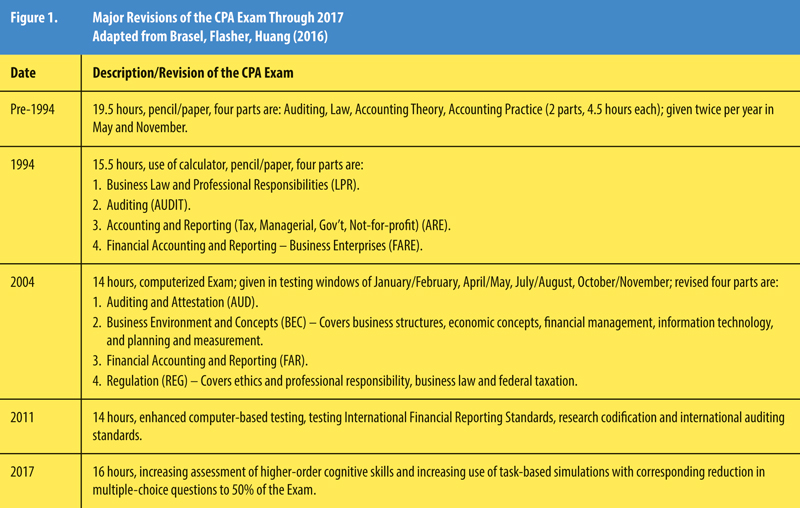

The first CPA Exam was administered in the state of New York in 1896 and by 1952, all states used the same uniform two- and one-half-day pencil-and-paper Exam (AICPA, 2020). Since then, four significant revisions in format and/or delivery have been implemented. Please see Figure 1.

In 2020, the National State Boards of Accountancy (NASBA) and the American Institute of CPAs (AICPA) voted to proceed with the CPA Evolution licensure model, resulting in another significant revision to the CPA Exam starting in January 2024. AICPA (AICPA and NASBA, 2021) sees these benefits to the new testing model.

This model:

- Will enhance public protection by producing candidates who have the deep knowledge necessary to perform high-quality work, meeting the needs of organizations, firms and the public.

- Is responsive to feedback, as it builds accounting, auditing, tax and technology knowledge requirements into a robust common core.

- Reflects the realities of practice, requiring deeper proven knowledge in one of three disciplines that are pillars of the profession.

- Is adaptive and flexible, helping to future-proof the CPA as the profession continues to evolve.

- Results in one CPA license.

The purpose of this article is to describe the new Exam so that CPA candidates, practitioners and educators can prepare for the changes. We will also discuss the transition policy for those who have not completed the Exam before the January 2024 launch date. A more comprehensive explanation of the changes is available in the Exposure Draft, Maintaining the Relevance of the Uniform CPA Examination® – Aligning the Exam with the CPA Evolution Licensure Model (AICPA, 2022a).

Structure of 2024 Exam

Under the new model, all candidates will be required to demonstrate a meaningful understanding of accounting by passing each of three Core Exam sections:

- Auditing and Attestation (AUD),

- Financial Accounting and Reporting (FAR), and

- Taxation and Regulation (REG).

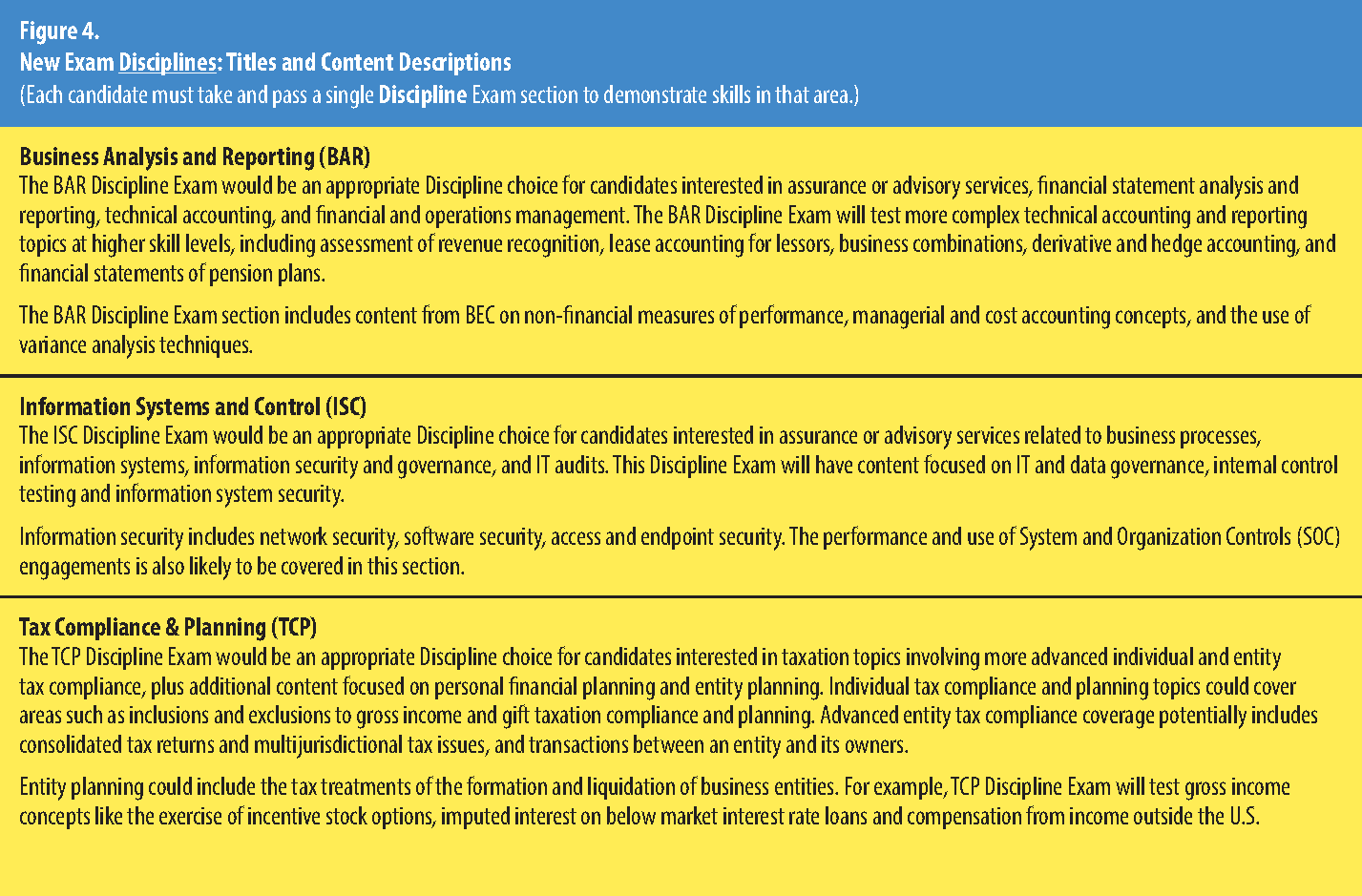

In addition to the three Core sections that all candidates will take, each candidate will choose one of three Discipline Exam sections in which to demonstrate deeper skills and knowledge. The three Discipline Exam sections are:

- Business Analysis and Reporting (BAR),

- Information Systems and Controls (ISC), and

- Tax Compliance and Planning (TCP).

No longer will all candidates take an identical four-part Exam as has been the case throughout the Exam’s history. No differentiation will appear on an individual’s CPA license as to the type of Discipline section passed, and each candidate may complete only one Discipline Exam. (If a candidate takes a Discipline Exam section and does not pass, or loses credit for a passed Exam section, they can choose to take any of the Discipline Exam sections.)

Discipline sections are meant to allow future CPAs to choose a path that interests them but does not require a commitment to work in a specific area.

Realignment of 2024 Exam Content

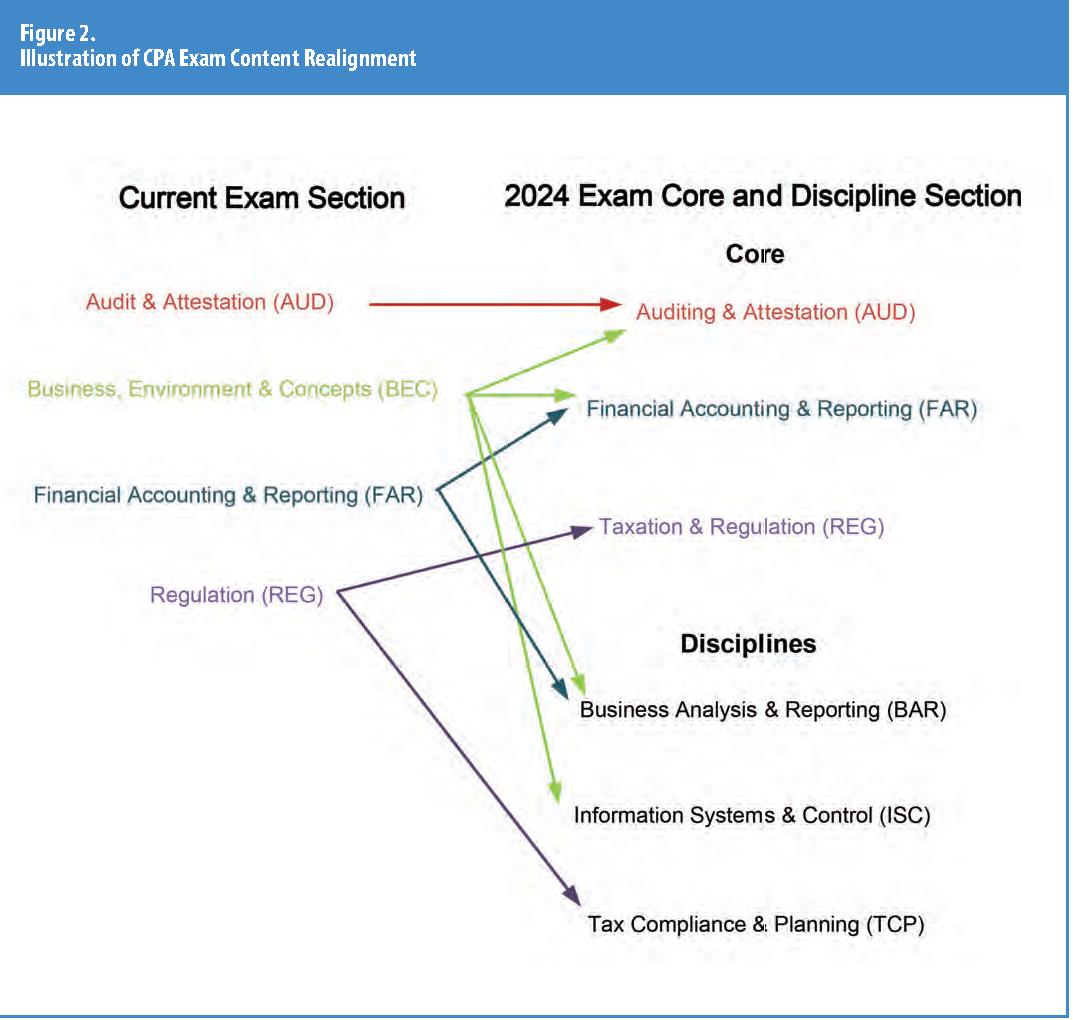

The implementation of three Core sections and three Discipline sections requires realigning the existing CPA Exam content and identifying new content to be assessed. The BEC section has been eliminated and its content moved to either the AUD or FAR Core sections, or BAR or ISC Discipline sections. Data and technology are tested at some level in all of the Core and Discipline sections, not only the ISC Discipline. Please see Figure 2 for a diagram illustrating the realignment of content.

Figure 3 and Figure 4 summarize the content of the Core section and the Discipline sections.

Design of 2024 Exam

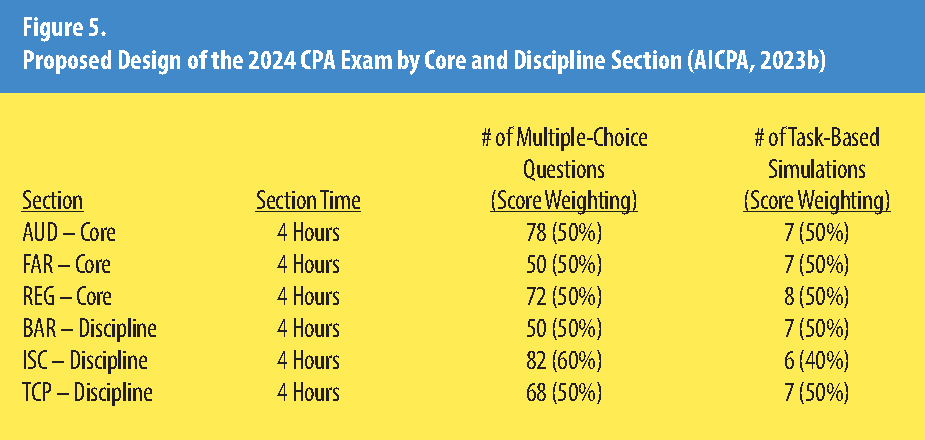

Each Core and Discipline Exam will be composed of a combination of multiple-choice questions and task-based simulations. Figure 5 presents the design of the 2024 CPA Exam by Core and Discipline section.

Infrastructure Changes

AICPA plans the following infrastructure changes for the 2024 Exam (AICPA, 2022b):

- Assessing research and related critical thinking skills differently;

- Replacing the Excel spreadsheet with a JavaScript based one;

- Removing the Written Communication Task (essay question); and

- Eliminating multistage adaptive testing (where the difficulty of the Exam is dynamically personalized) in the multiple-choice question testlets.

Transition Policy

None of the sections of the current CPA Exam will be available for testing after December 2023, but a transition policy exists for candidates who have started but not finished the current Exam by then.

Candidates who have credit for AUD, FAR or REG on the current Exam will not need to take the corresponding new Core section of AUD, FAR or REG. The candidate will retain credit for the corresponding Core sections for the remainder of their rolling 18-month window from the date they passed each part.

Candidates who have passed BEC before January 2024 will not have to take any Discipline section but those who have not passed BEC prior to January 2024 must select one of the three Discipline sections. A candidate who loses credit for any of these sections must take the corresponding Core section or one of the three Discipline sections that are on the new Exam.

Preparing for the New Format

As the environment in which CPAs practice changes, so must the Exam that assesses the entry-level skills of those practicing in that environment. Awareness of the changes to the 2024 Exam will help CPA candidates, educators and practitioners be prepared to adapt to the new format.

This article provides only a brief overview of the significant changes. For a more exhaustive look, visit AICPA’s website at aicpa.org (AICPA, 2023b).

About the Authors:

Jane N. Baldwin, Ph.D., CPA (inactive), is an accounting professor at Baylor University. She may be contacted at Jane_Baldwin@baylor.edu.

R. Kathy Hurtt, Ph.D., CPA (inactive), is an associate accounting professor at Baylor University. She may be contacted at Kathy_Hurtt@baylor.edu.

David Hurtt, Ph.D., CMA, is an accounting professor at Baylor University. He may be contacted at David_Hurtt@baylor.edu.

Bibliography

Association of International CPAs (AICPA), (2020) “What is the American Institute of CPAs (AICPA)?” https://corporatefinanceinstitute.com/resources/careers/jobs/american-institute-of-cpas-aicpa/ (Retrieved 8/20/2022).

AICPA and NASBA. (2021) “CPA Evolution: New CPA Licensure Model.” https://evolutionofcpa.org/Documents/CPA%20Evolution%20Brochure%20-%20May%202021.pdf (Retrieved 8/20/2022).

AICPA, (2022a). “Exposure Draft: Maintaining the Relevance of the Uniform CPA Examination – Aligning the Exam with the CPA.” https://www.aicpa.org/resources/download/exposure-draft-proposed-2024-cpa-exam-changes (Retrieved 8/20/2022).

AICPA, (2022b) “Infrastructure Changes to the CPA Exam in 2024” https://www.aicpa.org/resources/download/infrastructure-changes-to-the-cpa-exam-in-2024 (Retrieved 8/20/2022).

AICPA, (2023a) “AICPA Releases Blueprints for 2024 CPA Exam, Aligned With New Licensure Model.” https://www.nysscpa.org/article-content/aicpa-releases-blueprints-for-2024-cpa-exam-aligned-with-new-licensure-model-010523#sthash.w5Linpsm.dpbs (Retrieved 1/19/2023).

AICPA, (2023b) “Uniform CPA Examination Blueprints.” https://www.aicpa.org/resources/article/learn-what-is-tested-on-the-cpa-exam (Retrieved 1/19/2023).

Brasel, K., Flasher, R. Huang, S. “The Only Constant is Change: Upcoming Changes to the Uniform CPA Exam.” Today’s CPA, Sept/Oct 2016.