Special Supplement - Women in Leadership

Breaking Through the Glass Ceiling - How Women in Accounting and Finance Can Break Barriers and Become Rising Powers in the Profession

By Carolyn Kmet

This special report supported by CROWE LLP

In the 1950s, women accounted for less than a third of the American workforce. For 2020, the Bureau of Labor Statistics reported that the share of women who participated in the labor force was 56.2%. Thankfully, today’s workforce is much more diverse, but it was a long time coming – and there’s still a lot of ground to cover to move more women into the leadership ranks.

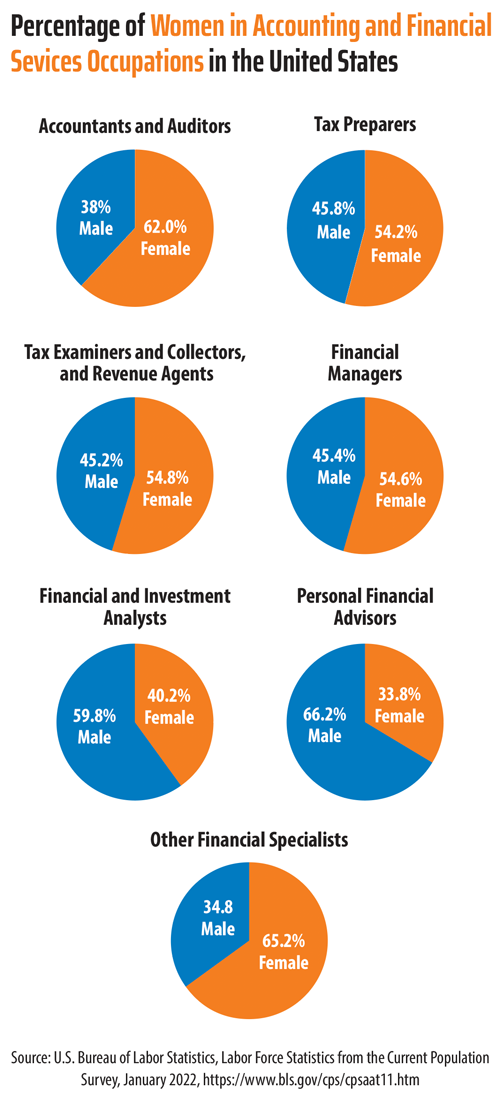

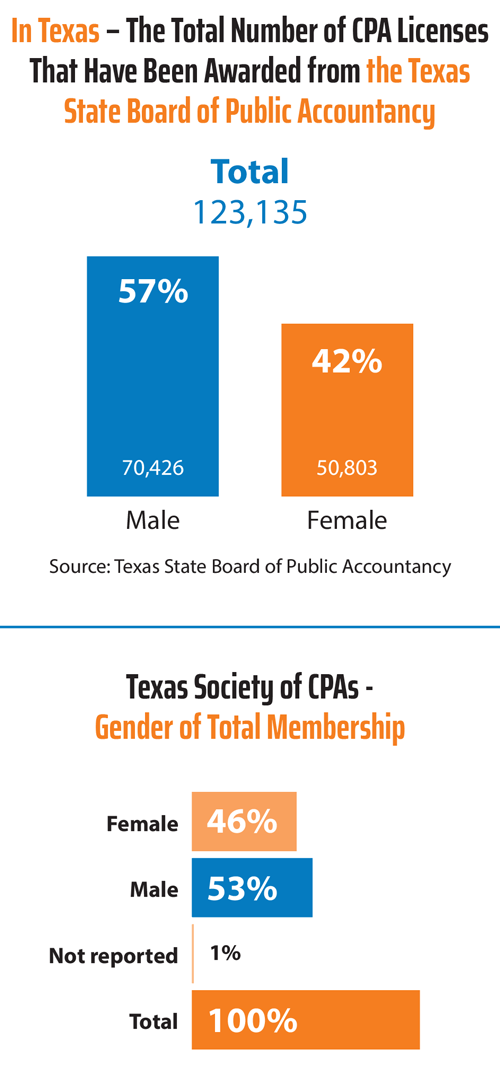

Within today’s financial services sector, women made up 62% of accountants and auditors in 2021. Women are also increasingly assuming leadership roles within firms. While still only about 27% of firm partners and principals are women, they now account for a third of management committee roles, about double that of a decade ago, according to Catalyst.org’s 2020 data.

Unfortunately, that level of participation doesn’t extend further. From a lack of role models to the unconscious biases of business leaders, there are a variety of reasons why women have struggled to climb the corporate ladder. It’s time for that to change. For any woman who hopes to one day sit in the C-suite, here are some of the challenges you will face and how you can build your executive presence despite them.

Yesterday’s Struggles

Julia Haried is a consultant with Deloitte Consulting LLP. She also happens to be a Forbes 30 Under 30 honoree thanks in part to her co-founding MakerGirl, an organization focused on encouraging young girls to pursue Science, Technology, Engineering and Mathematics (STEM) fields. Her inspiration? Her mother.

“When my mother attended high school in suburban Chicago in the 1970s, she was the only female student in her General Woods, General Metals and Architectural Drawing classes,” Haried recalls. “She had to have the desire and the will to ask to be included.”

Inclusion aside, once Haried’s mother successfully completed her courses, she had nowhere to apply her new skills. Architecture was not a welcoming profession for women at the time. In fact, many professions then were “off limits” to women.

Editor’s Note: Read this article on accounting is a STEM field.

Today’s Challenges

While the number of women in the financial services sector has steadily grown, there’s still a bias, unconscious or not, making it difficult for women to reach leadership positions.

Related ArticleWomen in TXCPA's Leadership Today's CPA magazine asked a few of our female leaders to share their advice on leadership in the accounting profession. |

“The field of public accounting, for example, has typically had challenges retaining women. We see fewer women get to the highest levels of leadership – or at least not in the same numbers as we see our male colleagues ascend,” says Dara F. Castle, CPA, managing partner of RSM US LLP and the firm’s Washington Metro market leader and government contracting national industry practice leader.

This hurts not just women but the organizations that employ them. Castle, who also leads RSM’s women’s initiative, which is part of the firm’s culture, diversity, and inclusion program, believes the lack of diversity is a business risk. “There is a tremendous amount of research that proves pretty unequivocally that the more diversity of perspective gained by having more women in leadership, as well as by having a more diverse population in leadership, the better your organization will be, the more profitable you’ll be, and the more innovative you’ll be,” Castle stresses.

Additionally, the lack of women in the C-suite tends to be a self-reinforcing cycle – when the only leaders employees see are men, they’re likely to subconsciously associate leadership with men.

“In STEM fields, like many other male-dominated fields, you see fewer women in leadership due to unconscious bias and systematic barriers,” says Sheila Murphy, president and CEO of Focus Forward Consulting.

A Few Facts On Executive Roles for Women and Racial and Ethnic Minorities

- Women made up 16% of CFOs in 2022, which is up from 6.3% in 2004;

- Racial and ethnic diversity among CFOs and CEOs has increased; the percentage of companies with diverse CFOs is about 10%, up from 5.2% in 2014 and 2.9% in 2004, and the percentage of companies with diverse CEOs tracks at about the same rate;

- Women make up 8% of chief executives, which is also an all-time high;

- In 2022, the number of CEOs who are women increased for the fourth consecutive year, most of them in the financial sector;

- That CFO-to-CEO trajectory is most common in the financial sector; about 26% of CEOs in the financial sector came directly from a CFO position, and the industrial, services and consumer sectors were next, each at 17%;

- CFOs who earn an undergraduate degree in business overwhelmingly major in accounting; 61% of CFOs graduated with an undergraduate degree in business and 45% of those majored in accounting.

Source: Kevin Brewer, The Number of CFOs Who are Women Hits an All-Time High, Journal of Accountancy, February 2, 2023,

Read more on this topic! Go to TXCPA's website for the article "Why Women are Critical for Your DEI Initiative."

Consider the concept of sponsorship, a relationship where someone, typically in a senior position, actively champions an individual’s capabilities and skill sets, and promotes them for opportunities. “Most people tend to sponsor people who look like themselves,” Murphy says. Fewer women in leadership roles translates to less mentoring, less diversity and therefore, fewer sponsorship opportunities for other women.

Worse even: There are still negative assumptions that shade the rise of women into leadership roles.

“Many women who have been wildly successful are also the ones who might be labeled as cold or cutthroat at first glance,” says Cathy Miron, president and CEO of eSilo. “The reality is that no matter your gender, success requires a certain amount of grit and fortitude to survive the climb to the very top of your field, but I feel women are more harshly judged than men.”

As uncomfortable as it may be, it’s critical to acknowledge and address these situations head-on and to continue advocating for equity in the workforce.

“We need to train people on how unconscious bias impacts assignments, feedback, performance reviews and mentoring,” Murphy says. But there is hope for change. More women in the workforce are speaking up and many companies are actively working to ensure organizational diversity. Additionally, a shift in the corporate culture, away from the work-is-life mentality, is helping to tip the scale.

“Historically, the financial services profession demanded time commitments. Moving up the corporate ladder meant working long hours, period,” Castle recollects. “As our profession moves toward a more flexible work environment, women are better able to achieve a work-life integration where they can have a fulfilling personal life while pursuing their professional goals and passions.”

Tomorrow’s Promise

As corporate culture changes and more women find powerful voices and advocate for themselves, a larger systemic shift follows. Many organizations and schools are now actively targeting girls at a young age to introduce them to STEM programming and other male dominated career paths.

The Climb Ahead

Though there’s growing societal awareness of the barriers women face in the workplace, earning a seat at the table is still an enormous challenge. Young women who want to gain executive presence should actively engage coworkers, build valuable connections and be willing to speak up about leadership goals.

“Look for opportunities to demonstrate and practice your leadership skills, whether that’s through outside professional organizations or serving on committees inside your company,” says Dorota Shortell, CEO of Simplexity, a product development engineering firm.

Miron stresses that it’s important for women to cultivate a personal and professional brand that displays confidence and competence, while also showing that they’re approachable, nurturing and friendly. “Don’t be intimidated if you are the only woman in the room – be proud. Be someone who thrives on the challenge of proving you can do something that others think you can’t.”

To accomplish this, Miron advises pulling together a support network of women mentors at work, in your family and among your friends. “The journey to the top can feel lonely at times, but having a personal board of advisors and a network of women who have faced the same struggles will help you rise and overcome whatever challenges you face.”

That is how change happens. That is how barriers are broken. That is how you unleash the power of you.

Sources:

U.S. Bureau of Labor Statistics, Women in the labor force: a databook, March 2022.

U.S. Bureau of Labor Statistics, Labor Force Statistics from the Current Population Survey, January 2022

Preceding article reprinted courtesy of Insight, the magazine of the Illinois CPA Society. Original publication: Spring 2020. For the latest issue, visit www.icpas.org/insight.