Putting a Pink Collar on the Fraud Diamond

By Deborah L. Lindberg, DBA, MBA, CPA; Jomo Sankara, Ph.D., ACMA, CGMA; and Kristie M. Young, DBA, MBA, CMA

According to the Federal Bureau of Investigation’s 2019 Crime in the U.S. report, embezzlement was one of only two offenses where women were charged more frequently than men (FBI, 2019).

In 1989, the researcher Dr. Kathleen Daly published a study on fraud committed by women, noting the increase in women embezzlers (Daly, 1989). She focused on the differences between white-collar crime (white-collar workers who commit embezzlement, fraud or forgery) and pink-collar crime (white-collar crimes committed by women) and found that pink-collar crime has distinct characteristics from white-collar crime.

Two differences relate to the economic gain and motivation. On average, women stole 10 times less money than men and the most common motive cited by women was their family’s financial need, while men experienced motivation based on personal and family need equally (Daly, 1989).

More recent research continues to support differences. In 2014, Christopher Marquet, whose firm publishes the Marquet Report on Embezzlement, stated that the embezzlements committed by women continue to rise. He also posits that possible contributing factors to this pattern in embezzlement include that there are relatively more women in the workforce, more women are bookkeepers and women now have equal opportunity for fraud (Powell 2014). In contrast, Marquet reports around 90% of Ponzi schemes are perpetrated by men.

In the 2018 Catch Her If You Can webinar, Kelly Paxton, a former federal agent, was interviewed by Gary Zeune, a CPA who has a speakers bureau for white-collar criminals. Paxton said that women steal around $0.45 to $0.50 on the dollar compared to men. One possible reason is that women in lower-level positions have access to less money.

The main types of justification women give for embezzling are loyalty (family needs) and lifestyle (luxury), and women are more likely to have a gambling problem. Also, once women are caught, they tend to admit their guilt right away (Paxton 2018).

The Fraud Diamond

There are several factors that lead to white-collar and pink-collar crimes. David T. Wolfe of the Glasgow Forensic Group and Professor Dana Hermanson formulated the fraud diamond2 model, which proposes perceived motivation, perceived opportunity, rationalization and capability as the four components of fraud (Wolfe and Hermanson, 2004).

The model extends the fraud triangle developed by criminologist Donald Cressey in 1950, which shows perceived motivation, perceived opportunity and rationalization as the three elements of fraud. Therefore, the fraud diamond adds capability to the fraud triangle as an essential element in determining whether opportunity will ultimately lead to fraud.

Perceived motivations are financial or non-financial factors that can pressure individuals, or provide incentives to individuals, to commit fraud. Examples of perceived financial pressures include falling sales, greed, living beyond one’s means and unexpected financial needs (Albrecht, Albrecht and Albrecht, 2008; Albrecht et al., 2010). Alternatively, fear of losing a job, ego, reputation and challenge to beat the system are all examples of non-financial factors (Kassem and Higson, 2012). Pressure can be further categorized into personal, employment and external pressure (Lister, 2007; Kassem and Higson, 2012).

Perceived opportunity represents the ineffective control or governance systems that enable fraud to take place. Factors such as related party transactions, ineffective monitoring, effectiveness of the board of directors over management activities and irregular job rotation can impact perceived opportunity (Abdullahi and Mansor, 2015).

Rationalization represents the third component of the fraud diamond. This represents the justification for fraudulent behavior due to the individual’s lack of moral reasoning and personal integrity (Rae and Subramaniam, 2008). Rationalization provides excuses for unethical behavior such as “I had to steal to provide for my family” and “I was entitled to the money because my employer is cheating me.” (Abdullahi and Mansor, 2015)

This third component of fraud bridges motivation with opportunity when the individual can rationalize the unethical behavior (Howe and Malgwi, 2006). In fact, auditing statement SAS No. 99 (AU Section 316, paragraph 7) states that the greater the pressure, the more likely the individual continues to “rationalize the acceptability of committing the fraud.”

Capability enables a motivated individual to recognize the opportunity to commit fraud and have the ability and skills to carry it out. This element includes the traits and skills necessary to commit fraud.

Essentially, the major traits of fraudsters are the individual’s intelligence, experience, creativity, confidence, ability to influence others to participate in (or cover up) the fraud, ability to effectively lie and ability to deal with stress (Wolfe and Hermanson, 2004). Such a personality will have a strong understanding of the internal control system and know how to exploit its weaknesses. Consequently, fraudsters may get capability from their position in the company and are likely to be executives or managers.

Fraudsters are likely to be egotistic, which can affect the individual’s cost-benefit analysis of committing fraud, as they may believe there is a low probability of being caught. Relatedly, the fraudster may crave power and delight in showing how superior they are to others by successfully navigating the fraud (Wolfe and Hermanson, 2004).

Furthermore, a fraudster might be a persuasive leader or “bully” who forces others to participate in the crime and/or cover it up. Finally, the fraudster functions well under stress and is able to lie consistently and effectively (Wolfe and Hermanson, 2004).

The components of the fraud diamond are clearly inter-related. For example, an individual’s traits may enable the individual to rationalize the unethical behavior. The traits may also provide motivation for committing a fraud. It is also conceivable that an individual’s capability, such as to design, set up, monitor or change the internal control system, can help him/her to create opportunity. The fraud diamond can be used to assess the risk and help prevent or detect fraud. Figure 1 depicts the Pink Fraud Diamond.

Pink-Collar Crime and the Fraud Diamond

We use the fraud diamond to demonstrate factors that can lead to pink-collar crimes.

Rationalization: According to the National Women’s Law Center and the Census Bureau, women earn $0.80 for every dollar that men earn for full-time work. The center also describes several factors that contribute to this wage gap beyond women being paid less than men for the same job.

First, career choice has a significant impact on income. Women are underrepresented in higher paying jobs and overrepresented in lower paying jobs. Second, it is common for women to take on more caregiving responsibilities at home and face bias in the workplace because of it, commonly referred to as the “motherhood penalty.”

Also, women with more caregiving responsibilities may experience financial consequences when workplace policies are not family friendly (National Women’s Law Center, 2018).

Regardless of why it happens, the disparity in wages and the bias present in organizations can serve as a rationalization for fraudulent acts.

Motivation: Frequent pressures experienced by female fraudsters are related to loyalty and lifestyle. Loyalty refers to women trying to meet their family’s needs. Examples of large expenses that create pressure to commit fraud are medical bills and college tuition (National Women’s Law Center, 2018). In such situations, the money women steal is spent on others, typically family members.

On the other hand, some women want to experience or maintain a luxurious lifestyle. Paxton refers to the “three Cs” of lifestyle pressure, which include cars, clothes and casinos. As mentioned previously, women are more likely than men to have a gambling problem (Paxton, 2018).

Opportunity: Embezzlement, which is also committed more frequently by women than men, happens more often in small businesses and nonprofit organizations. Typically, these companies have fewer employees, which means that an individual can have responsibility for several duties that would ideally be assigned to multiple people (Powell, 2014).

In 2009, about 75% of workers in the nonprofit sector were women (The White House Project, 2009). This may be a contributing factor to the high number of female embezzlers.

Also, there are relatively more women than men who are bookkeepers (Powell, 2014). Generally, bookkeepers have access to the company’s books, checks and bank accounts. This puts a bookkeeper in the prime position to commit fraud, particularly if they are in a small organization without proper segregation of duties.

Capability: More women are pursuing higher education. In the 2015-2016 school year, 57% of the bachelor’s degrees were earned by women (NCES, 2016). This is helping women reach top-level positions in their organization. In 1980, women held 25% of management positions, but by 2010, 40% of management positions were held by women (Scarborough, 2018).

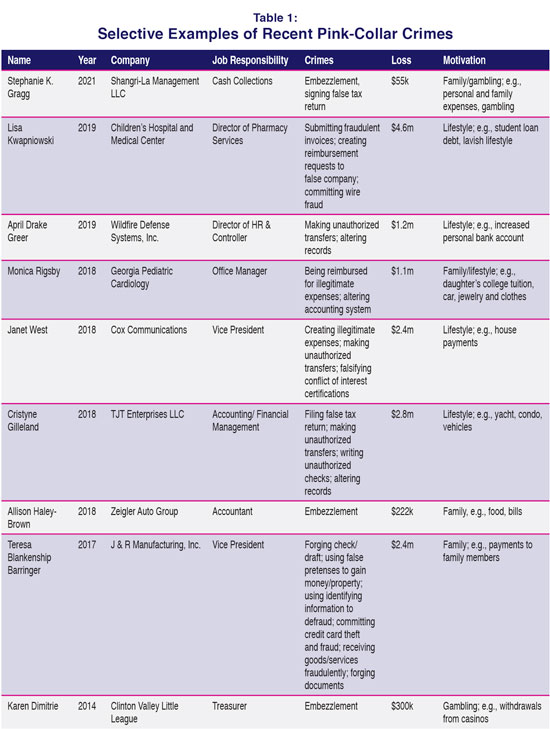

Unfortunately, along with this progress comes higher cost embezzlements. The Association of Certified Fraud Examiners’ 2020 Report to the Nations notes a correlation between education level and median loss, such that the higher the position a fraudster has in a company, the higher the dollar amount of fraud (ACFE 2020). Table 1 shows several cases of embezzlements committed by women.

Lisa Kwapniowski’s case exemplifies many common elements of pink-collar crime and the fraud diamond. She worked for a nonprofit organization, the Children’s Hospital and Medical Center, in Omaha, Nebraska.

Kwapniowski worked in a higher-level position as a pharmacy director. A Senior U.S. District Court Judge commented on her intelligence, which contributes to her capability to commit a complex crime. Her attorney shared that she “came clean” quickly once the investigation began. Finally, an assistant U.S. attorney reasoned that Kwapniowski stole the money because she wanted a lavish lifestyle (Anderson, 2019).

Figure 1: The Pink Fraud Diamond

Perceived Opportunity:

• Ineffective control or governance systems

Perceived Motivation:

• Financial and non-financial personal, employment and external pressure

• Incentives to commit fraud

Capability:

• Ability and skills to execute fraud

• Understanding of internal control system

• More likely to be executives or managers

Rationalization:

• Justification for fraudulent behavior

• Bridges motivation with opportunity

• Pressure increases rationalization

Prevention of Pink-Collar Crime

According to the Association of Certified Fraud Examiners’ 2020 Report to the Nations, businesses lose an estimated 5% of annual revenue due to employee fraud (ACFE, 2020). Additionally, companies can experience a loss of customers, difficulty gaining new customers, a loss of partners and a damaged reputation (Hiscox, 2018). Therefore, it is essential to have strong internal controls in place to prevent fraud, including pink-collar crime.

Internal controls such as segregation of duties can reduce the opportunity for fraud. Functions that should be carried out by separate employees include the custody of cash, accounting for cash operations, monitoring performance of cash operations and financial statement preparation (Lindquist and Goldberg, 2009).

Employee rotation, mandatory vacations, an employee hotline and internal audit procedures can also help prevent pink-collar crimes (Lindquist and Goldberg, 2009). This can be especially important in smaller organizations, which hire a high percentage of women. Furthermore, researcher Clare Tilton provides information that supports the argument that whistleblower hotlines that offer financial incentives could provide a strong deterrent for women who wish to commit fraud. This is because although women may be less likely to be motivated by money in their whistleblowing decision-making, they may expect financial remuneration to play a bigger role in the decisions made by their work colleagues.

Fraud may be committed by employees who find themselves in difficult situations and women may encounter different situations than men. Thus, despite strong internal controls, motivated employees may still find a way to commit fraud, particularly women who feel pressure to carry out fraud to protect and care for their families.

To help reduce the likelihood of pink-collar crimes, employers should consider implementing programs that support employees and their families. For example, companies should consider providing adequate insurance to employees to help support employees and their families in times of need. Employee Assistance Programs (EAPs) to help women with personal and family issues may help prevent fraudulent behavior.

Strong internal controls may also be undermined by employees in positions to override controls, such as executives and managers, and by intelligent staff members who have sufficient understanding of the internal controls to circumvent their effectiveness. As women increasingly fill leadership positions in companies, their capability to commit fraud is correspondingly increasing. Furthermore, women with good business and accounting knowledge who are placed in positions of trust in companies with little internal controls have both an opportunity and the capability to carry out pink-collar crime.

In addition to risk assessment and reviewing the effectiveness of internal controls, companies may wish to carry out background checks on new employees and provide regular mandatory fraud awareness and ethics training to all employees. Such training will include emphasizing the substantial reputational and financial cost of unethical behavior, both to the individual and to the company. This training can highlight the additional risk and cost to the family when the perpetrator is caught, which could be particularly effective in discouraging pink-collar fraud.

Forensic accounting can also be deployed to discover fraudulent behavior. The forensic accountants should have expertise in pink collar crime in order to detect this fraud as soon as possible.

Although any unethical person could rationalize fraudulent behavior, employees with grievances may be more likely to do so. Women may have specific grievances such as inequity in pay and opportunities for advancement. Therefore, providing equal opportunities to all employees and making relevant employee services available to women could help prevent or reduce crimes.

Recognition and Differences

Women continue to be charged with embezzlement more frequently than men (Powell, 2014). Therefore, it is important to pay attention to the differences between pink-collar crime and white-collar crime regarding the elements of the fraud diamond.

Of course, the best way to manage pink-collar crime is prevention. By implementing strong internal controls, and considering women’s needs and grievances, employers will be better prepared to prevent pink-collar crime.

About the Authors

Jomo Sankara, Ph.D., CGMA, is an associate professor of accounting at Illinois State University. He can be contacted at 309-438-2266 or via email at jlsanka@ilstu.edu.

Deborah L. Lindberg, CPA, MBA, DBA, is a professor of accounting at Illinois State University. She can be contacted at 309-438-7166 or via email at dllindb@ilstu.edu.

Kristie M. Young, CMA, MBA, DBA, is an associate professor of accounting at Illinois State University. She can be contacted at 309-438-7908 or via email at kmyou13@ilstu.edu.

References

Abdullahi, Rabiu, and Noorhayati Mansor. “Forensic accounting and fraud risk factors: the influence of fraud diamond theory.” The American Journal of Innovative Research and Applied Sciences 1, no. 5 (2015).

Albrecht, Chad, Chad Turnbull, Yingying Zhang and Christopher J. Skousen. “The Relationship Between South Korean Chaebols and Fraud.” Managerial Auditing Journal (2010).

Albrecht, W. Steve, Chad Albrecht and Conan C. Albrecht. “Current Trends in Fraud and its Detection.” Information Security Journal: A Global Perspective (2008).

Anderson, Julie. “Former Children’s Pharmacist Sentenced to 4 Years in Federal Prison After Embezzling $4.6 million.” Live Well Nebraska (2019) https://www.omaha.com/livewellnebraska/former-children-s-pharmacist-sentenced-to-years-in-federal-prison/article_45068fca-238e-5591-bfe9-e21a0b3cbd94.html.

Association of Certified Fraud Examiners (ACFE). “Report to the Nations: Global Study on Occupational Fraud and Abuse.” (2020) https://acfepublic.s3-us-west-2.amazonaws.com/2020-Report-to-the-Nations.pdf.

Daly, Kathleen. “Gender and varieties of white?collar crime.” Criminology 27, no. 4 (1989).

Federal Bureau of Investigation (FBI). “Crime in the United States.” (2019) https://ucr.fbi.gov/crime-in-the-u.s/2019/crime-in-the-u.s.-2019/topic-pages/tables/table-33

Hiscox. “Hiscox Embezzlement Study™: An Insider’s View of Employee Theft.” (2018) https://www.hiscox.com/documents/2018-Hiscox-Embezzlement-Study.pdf

Howe, Martha A., and Charles A. Malgwi. “Playing the ponies: A $5 million embezzlement case.” Journal of Education for Business 82, no. 1 (2006).

Kassem, Rasha and Andrew Higson. “The New Fraud Triangle Model.” Journal of Emerging Trends in Economics and Management Sciences (2012).

Lindquist, Stanton C., and Stephen R. Goldberg. “Embezzlement: Don’t be a victim!” Journal of Corporate Accounting & Finance 20, no. 4 (2009).

Lister, Linda M. “A Practical Approach to Fraud Risk: Comprehensive Risk Assessments Can Enable Auditors to Focus Antifraud Efforts on Areas Where Their Organization is Most Vulnerable.” Internal Auditor (2007).

National Center for Education Statistics (NCES). “Digest of Education Statistics.” (2016) https://nces.ed.gov/programs/digest/d17/tables/dt17_318.30.asp.

National Women’s Law Center. “FAQ about the Wage Gap.” (2018) https://nwlc.org/resources/faq-about-the-wage-gap/.

Paxton, Kelly. “Catch Her if You Can.” Webinar, CPA Crossings, (2018).

Powell, Tony. “The Changing Face of Fraud.” CPA Practice Management Forum (2014): 20–25.

Rae, Kirsty, and Nava Subramaniam. “Quality of internal control procedures.” Managerial Auditing Journal (2008).

Scarborough, William. “What the data says about women in management between 1980 and 2010.” Harv Bus Rev (2018).

The White House Project. “The White House Project: Benchmarking Women’s Leadership.” (2009)

Wolfe, David T. and Dana R. Hermanson. “The Fraud Diamond: Considering the Four Elements of Fraud.” CPA Journal (2004).