January 13, 2026

The Vicious Cycle of Cheating in Accounting: From Students to Practitioners

By Dr. Donald L. Ariail, Dr. Amine Khayati, Dr. Katherine Taken Smith, and Dr. Lawrence Murphy Smith

For the accounting profession to be successful in fulfilling its role in business and society, people must be confident that accountants are ethical and reliable. Accountants play critical roles in the proper functioning of a market economy. Investors, lenders, business managers, government regulators, and others rely on the work of accountants.

This article is based on a research study titled “Student and Practitioner Cheating: A Crisis for the Accounting Profession,” published in the Journal of Risk and Financial Management.1

Historically, the general public respects the integrity of the accounting profession.2 Due to the accounting scandals of the early 2000s and more recent scandals involving professionals at major accounting firms cheating on internal tests, public trust has been negatively affected. In a recent ranking of the 20 most trusted professions, accountants placed near the bottom at number 17.3

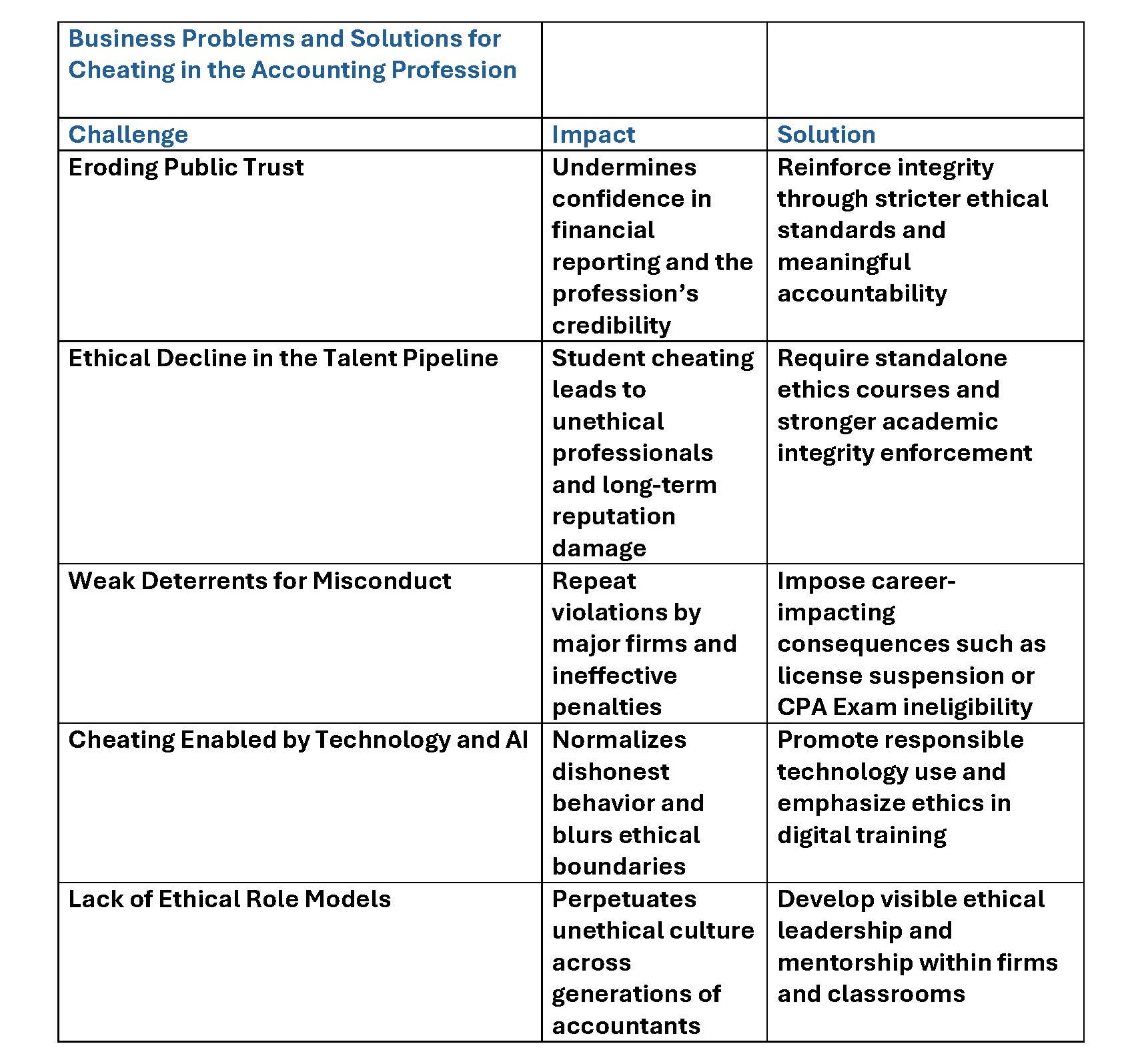

Along with recent cheating by accountant practitioners, there is a notable increase in cheating by accounting students.4 Current research indicates that students who cheat are likely to become practitioners who cheat, who then model unethical behavior for future accountants.5 This is a vicious cycle that needs to be stopped so that the accounting profession does not impair the trust of the public.

Have People Became Desensitized to Cheating?

According to the International Center for Academic Integrity in 2020, almost 30 percent of college students admitted to cheating on exams.6 With the increase in online exams and the accessibility of websites that facilitate cheating, cheating has increased. A 2024 study found that 54.7 percent of students cheat.7 Websites have materialized in the past couple of years that, for a fee, provide students with test banks and solution manuals.8

With the advent of artificial intelligence, cheating has become even more prevalent. In this regard, James D. Walsh titled his May 7, 2025, article in the New York Magazine “everyone is cheating their way through college.”9

With questionable resources at one’s fingertips, cheating has become simple to do. The 2024 study found that the most common reason for cheating was that the student had the opportunity.10 Accounting students may rationalize their cheating by using the theory of Ethical Egoism, which is a cost/benefit analysis.11 Another rationalization for cheating is the opinion that everyone is cheating; this is called Ethical Relativism and can impact norms of behavior.12

Research suggests that students who cheat in college are likely to cheat later in their work life.13 This means that accounting students who cheat in school may later engage in cheating in their professional accounting work. These accounting practitioners become role models for accounting students. Thereby, the actions of accounting practitioners, especially those in major firms, define the norms of behavior for future accountants. A vicious cycle of cheating is formed as college students mimic unethical role models.

Cheating by Accounting Practitioners

Over the past six years, some major accounting firms have been censured and penalized for cheating on exams, such as internal training tests, continuing professional education tests and, ironically, ethics exams. Due to cheating, firms have been censured and required to pay up to $100 million in penalties. The serial nature of this egregious ethical lapse is exemplified by one of these firms being censured and fined four times from 2019 through 2024.14

To some people, cheating on internal training tests and continuing professional education tests may not seem like a big deal. However, cheating is a dishonest act that indicates a lack of integrity.

The AICPA Code of Professional Conduct (AICPA, 2014) states that “integrity is an element of character fundamental to professional recognition. It is the quality from which the public trust derives and the benchmark against which a member must test all decisions.”15 As a matter of course, professionals who are dishonest in one area of practice are prone to be dishonest in other areas of practice, including performing attestations.

Action Needed by Practitioners and Educators

While potential monetary penalties and those actually assessed by the SEC and PCAOB are deterrents to cheating, they appear inadequate on their own. A stronger punishment would be more effective, one where the cost clearly outweighs the benefit.

The penalty for cheating should be as onerous as those bestowed on violations of Generally Accepted Accounting Principles (GAAP) or Generally Accepted Auditing Standards (GAAS). For example, CPAs who violate GAAP can be banned from public practice. Their license to practice can be withdrawn by the respective State Board.

In the case of practitioners without a CPA license who act unethically, new policies could be established to make unethical non-CPAs automatically ineligible to take the CPA Exam.

In college, steps can be taken to train future CPAs on professional and ethical behavior before they become desensitized to cheating. In most cases, throughout the U.S., ethics instruction is integrated into existing accounting classes.

A few states, including Texas, require CPA Exam candidates to have completed a three-hour college course on ethics. Research shows that accounting students who take a class solely on ethics in accounting have greater ethical reasoning compared to accounting students who simply had ethics integrated into other classes.16

With this glimmer of hope, a course devoted to ethics in accounting seems to be worthwhile in instilling core values of the accounting profession: notably, honesty and integrity. A standalone accounting ethics course provides the time needed to delve deeper into accounting ethics codes and their application in real-world situations. Students can study past cases of accounting fraud that resulted in the loss of jobs, clientele and massive amounts of money.

Leading by Example: Ethics in Action

In a society that is becoming desensitized to cheating, could cheating become a social norm, detrimentally affecting the profession of accounting? Accountants must not allow this. Now is the time to end the vicious cycle of students cheating and becoming practitioners who cheat, who are then unethical role models to students.

Punishment for cheating needs to be harsh enough to deter this unethical behavior. The SEC, PCAOB and State Boards must establish severe penalties that are strong, effective deterrents.

Accounting leaders in practice and education must act to ensure the highest level of integrity in the accounting profession. Doing so will ensure that the profession maintains the public’s trust and thereby can continue to carry out its critical role in business and society.

About the Authors:

Dr. Donald L. Ariail is a Professor of Accounting at Kennesaw State University. Contact him at dariail1@kennesaw.edu.

Dr. Amine Khayati is Clinical Professor of Finance at Kennesaw State University. Contact him at akhayati@kennesaw.edu.

Dr. Katherine Taken Smith is a Professor of Marketing at Texas A&M University-Corpus Christi. Contact her at Katherine.Smith@tamucc.edu.

Dr. Lawrence Murphy Smith is a Professor of Accounting at Texas A&M University-Corpus Christi. Contact him at Lawrence.Smith@tamucc.edu.

End Notes

1. Ariail, D., Khayati, A., & Smith, L.M. (2025). Student and Practitioner Cheating: A Crisis for the Accounting Profession. Journal of Risk and Financial Management, 18(5), 285.

2. Baldvinsdottir, G., Hagberg, A., Johansson, I. L., Jonäll, K., & Marton, J. (2011). Accounting research and trust: a literature review. Qualitative Research in Accounting & Management, 8(4), 382-424; Smith, M. (2003). A fresh look at accounting ethics (or Dr. Smith goes to Washington). Accounting Horizons, 17(1), 47-49.Brewster, M. (2003). Unaccountable: How the accounting profession forfeited a public trust. John Wiley & Sons.

3. Mushtaque, A. (2023). 20 Most Trusted Professions in America. Yahoo!Finance. https://finance.yahoo.com/news/20-most-trusted-professions-america-094909043.html?guccounter=1.

4. Bierstaker, J., Brink, W. D., Khatoon, S., & Thorne, L. (2024). Academic fraud and remote evaluation of accounting students: An application of the fraud triangle. Journal of Business Ethics, 1-23; Fritz, A., Emerson, D. & Smith, K. (2024). Cheating in the Profession, Insights from Academia. The CPA Journal, Retrieved from https://www.cpajournal.com/2024/06/06/cheating-in-the-profession; Accountancy Age. (2025). Ethics in accounting: Can firms restore public trust? Accountancy Age. Retrieved from https://www.accountancyage.com/2025/01/21/ethics-in-accounting-can-firms-restore-public-trust.

5. Op cit., Ariail et al. (2025).

6 ICAI (2020). International Center for Academic Integrity. Facts and statistics.

7. Newton, P.M., Essex, K. (2024). How Common is Cheating in Online Exams and did it Increase During the COVID-19 Pandemic? A Systematic Review. Journal of Academic Ethics 22, 323–343. https://doi.org/10.1007/s10805-023-09485-5.

8. Kelly, M., Smith, K. J., & Emerson, D. (2022). Perceptions among UK accounting and business students as to the ethicality of using assignment assistance websites. The Accounting Educators' Journal, 32.

9. Walsh, James D. (2025). Everyone is cheating their way through college. New York Magazine, May 7.

10. Op cit., Newton (2024).

11. Holmes, R. L. (1998). Basic Moral Philosophy (2nd ed.). London, UK: Wadsworth Publishing Company.

12. Velasquez, M., Andre, C., Shanks, T, & Meyer, M. J. (1992). Ethical relativism. Markkula Center for Applied Ethics at Santa Clara University. https://www.scu.edu/ethics/ethics-resources/ethical-decision-making/ethical-relativism.

13. Op cit., Ariail et al. (2025).

14. Id., Ariail et al. (2025).

15. AICPA (2014). AICPA Code of Professional Conduct, December 15, 2014. https://us.aicpa.org/content/dam/aicpa/research/standards/codeofconduct/downloadabledocuments/2014december15contentasof2016august31codeofconduct.pdf.

16. Klimek, J., & Wenell, K. (2011). Ethics in accounting: an indispensable course? Academy of Educational Leadership Journal, 15(4), 107-119.

Thanks to the Sponsors of Today's CPA Magazine

This content was made possible by the sponsors of this issue of Today's CPA Magazine: